I am a single mother of 4 on a budget. I stock up on essentials to get the best deals

A single mother of four tells us she saves money by shopping at supermarkets.

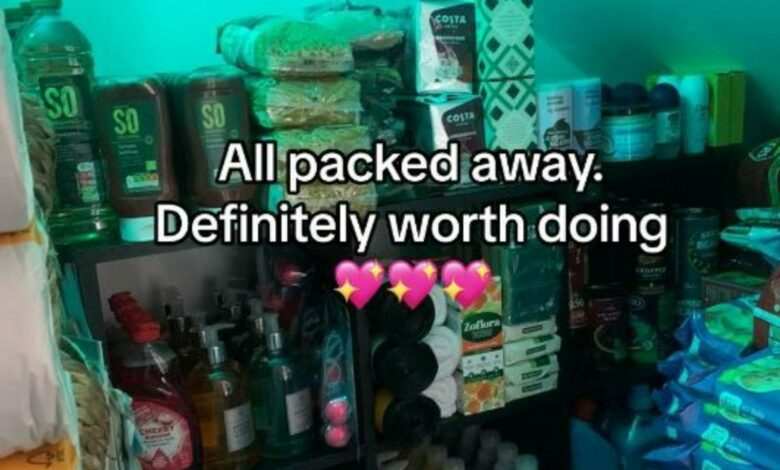

The mother who posts under this message @mummybudgetsshowed her house, laden with piles of goods, from shampoo to toothpaste.

In her video she wrote: “As a single mother of 4 on a budget, building up a year’s worth of household supplies.

“I received a delivery from Sainsbury’s.

“I put aside £40 each month to stock up on household items.”

Her first mega purchase was Little Ones shampoo and bath bottles, buying 13 products for 85p each.

The mother added that they “look amazing and smell wonderful.”

Next one She bought four for £2.60 each thanks to Nectar’s deals.

She also bought six bottles of Faith in Nature shampoo and conditioner for £3 using her Nectar card and put them in the cupboard to top up her stock.

The mother revealed how she managed to get her hands on nine tubes of Oral toothpaste for £3, four bottles of Sanex cleaning solution for £2 and six bottles of toilet gel for 65p each, which she described as ‘decent’.

She also had four bottles of lavender fabric softener with her, which she “loves the smell of”.

And the mother won’t be running out of fairy liquid any time soon, as she bought 10 bottles for 62p each.

And she also bought nine bottles of hand soap to stock her bathrooms.

The mother also added four bottles of canola oil oilnine bottles of ketchup, six £1.35 bags of pasta, seven packets of spaghetti, countless rolls of the “cheapest toilet paper” because “no one in my house cares”, and much more.

She concluded: “I do a shop like this every six months.

“Some things take three months, and others take a year.

“It will definitely save me money because I get everything that is for sale and I only have to worry about groceries.”

The mother showed a room in her house that was specially set up for the things she had bought in large quantities. There were bottles and packages neatly stacked.

Many other parents praised her money-saving strategy.

One said, “I did the same thing you did and save it the same way! Just give me more money for food or things to do and I won’t have to worry anymore!”

Another added: “I do this too! It saves me so much money, and what I would spend each month I put aside.”

And a third commented: “This is actually very clever.”

But someone said, “If I had a big enough house with enough storage, I would probably do the same thing.”

Money Saving Tips for Parents

WE HAVE put together 6 top tips for you to help you save money, score free stuff and avoid a fine.

- Free prescriptions and dental care – Prescriptions cost £9.15 each in England, while NHS dentistry costs vary by location. You can get both for free while you’re pregnant and for 12 months after your baby’s due date. Ask your doctor or midwife for a Maternity Exemption Certificate (MATEX) to claim the free care.

- Free milk, infant formula, vitamins or fruits and vegetables – Below the Healthy start If you take part in the programme, you may be eligible for the free perks if you are at least 10 weeks pregnant or have a child under four and receive certain benefits, such as Universal Credit.

- £500 free grant – In England, Northern Ireland and Wales, you may be eligible for a Sure Start grant of £500 if you receive certain benefits and are expecting your first child or more than one baby, such as twins. To apply, you must complete the following form: form on Gov.uk and have your doctor or midwife sign it.

- Register the birth on time or you risk a fine of £200 – You must register the birth with your local registry office within 42 days of your baby being born. This costs £11 in England and Wales.

- Updating or updating a will – If you don’t have a will, in England, Northern Ireland and Scotland, where one parent dies, children will only inherit money if the estate is worth more than £250,000 – otherwise all the money goes to the surviving spouse. If you don’t want this, you must make a will stating your wishes.

- Consider taking out life insurance – No one likes to think about death, but if something were to happen to you, would your family be able to survive without your salary? If not, you may want to consider life insurance. Use a comparison service to find not only the cheapest, but also the most suitable cover for your needs.