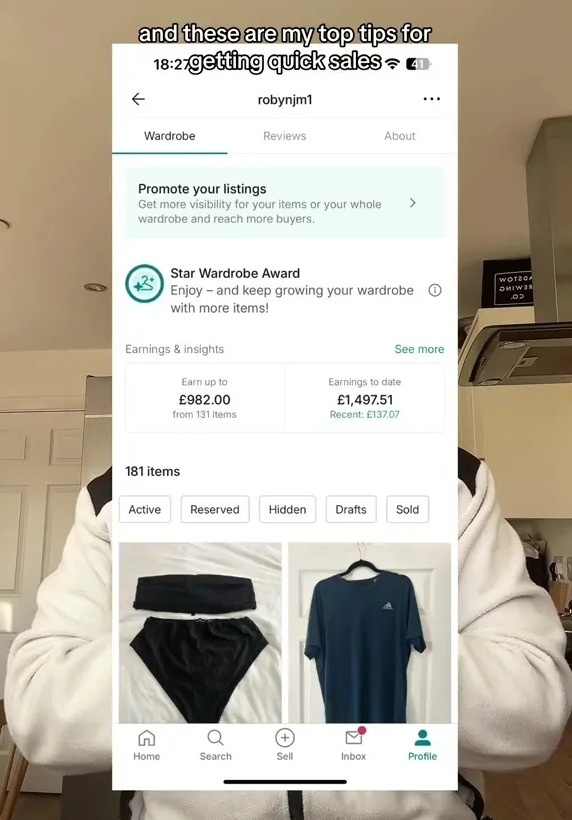

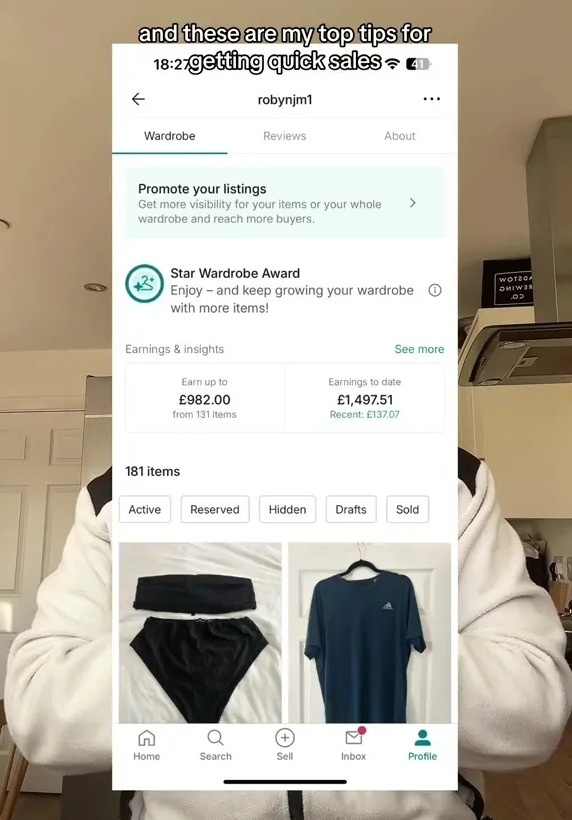

I made £1.5k on Vinted – the mistake people make and the clever trick I swear by

A WOMAN revealed she made just under £1,500 on Vinted thanks to five simple tips.

Robyn Mort, a smart side hustle tester from the UK, explains that people always make the same common mistake and that this is the reason their items don’t sell.

Additionally, the Vinted fan also shared the clever trick she swears by for the best captions.

Robyn shared her advice on social media, posting her clip with the caption ‘My top tips for making it on Vinted! Whether you’re decluttering or looking for great deals, these hacks will help you sell faster!’

Thanks to the online marketplace app, Robyn has made an impressive £1,497.51, as she confessed: “I’ve made almost £1,500 on Vinted and here are my top tips on how to sell fast and make the most money.”

Robyn explained that you shouldn’t be too quick to react and accept low bids right away. She stressed, “If you’ve just posted something and someone offers you a ridiculous price, don’t accept it.

“I know we all want to sell something quickly and get rid of stuff. Nobody wants clutter in their home, but if you’ve listed something for £20 and someone offers you £14 or £15, don’t sell it.

“There’s a good chance someone is going to pay that price for it. I’ve had so many items that I’ve had low bids on all day long and at the end of the day someone just bought it for the price I listed it for.”

Secondly, Robyn shared the common mistakes people always make, adding, “Post good pictures. Don’t post pictures that aren’t ironed, that aren’t washed, that have makeup on the collar, and don’t say there are stains on it.

“If you wash it yourself, you get more money for it.

“I’ve seen so many people posting pictures of unwashed clothes. Who would believe that?”

Additionally, Robyn revealed the trick she swears by for the best captions: “This is an important one: use ChatGPT to write your captions.

“One of the key ways Vinted works is that you need to provide as much information as possible about your item so that Vinted can promote the item to the people who are looking for that item.

“Yes, we can write it down pretty well – what color is it, what size is it, what item is it, but ChatGPT can give you a full breakdown with hashtags that will do well.

New Vinted rules to watch out for

IF you feel like cleaning out your wardrobe and getting rid of your old stuff on Vinted, you will have to take into account the new rules that have recently been introduced.

If people sell personal belongings for less than the original price (which is usually the case with second-hand sales), this has no tax implications.

However, since January 1, digital platforms including eBay, Airbnb, Etsy, Amazon and Vinted must share seller information with the tax authorities as part of a stricter policy.

If you only sell a few second-hand items online each year, you probably won’t have this problem. Normally, only business sellers who are looking to make a profit have to pay tax.

Since 2017, there has been a £1,000 tax-free allowance for business sellers trading for profit. A personal item is only taxable if it is sold for more than £6,000 and a profit is made on the sale.

However, businesses must now pass on your details to the Tax and Customs Administration if you sell 30 or more items a year or earn more than £1,700.

It is part of a broader tax campaign to ensure that people who increase their income through part-time work actually pay what they owe.

If you earn between £1,000 and £1,700, your details will not be shared with the tax office. However, you will still have to pay tax as normal.

“Honestly, this is a real game changer.”

And that’s not all: when it comes to shipping your stuff, the blonde beauty advised: “Make sure you send stuff in shipping bags, not in ridiculous packaging.

“And in good condition, I mean washed and lint roller, no one wants dog hair on it.

Which photos should you upload?

High quality and clear images make your items stand out on Vinted among the wide range of items available on the platform

Here are the five essential shots that The Sun’s Rose O’Sullivan contains:

- Photo one: A clear photo of the front of the dress, sportswear, pants, etc.

- Photo two: The back of the outfit

- Photo three: Photo of sleeve or pant length

- Photo four: Close-up of the stitching, or if there are any defects on the item, please include zoomed-in photos of these as well

- Photo Five: If it’s pants, take photos of the lining, zippers, or buckles

“Your reviews are important. When I buy an item on Vinted, I look at the reviews of that seller. If they are not good, I will not buy from them.”

Finally, if you want to make money selling your unwanted items, Robyn explained, “If you want to sell something quickly, I know it’s annoying, but try offering more shipping options.

Do I have to pay tax on items I sell on Vinted?

FAST tax facts from the Vinted team…

- The only time an item is taxable is if it sells for more than £6,000 and there is a profit (sells for more than you paid for it). Even then you can use your £3,000 tax-free capital gains allowance to offset it.

- Generally, only business sellers who trade for profit (buying goods with the intention of selling them for more than they paid for them) are required to pay tax. Business sellers who trade for profit can take advantage of a £1,000 tax-free allowance, which has been in place since 2017.

- More information here: vinted.co.uk/no-changes-to-taxes

“I have three stores and there is always one store that I dread going to, but I get so many sales because people want the delivery option.

“So if you don’t sell much and you only have InPost, you’re actually doing yourself a disservice.”

‘GREAT ADVICE’

The TikTok clip, which was posted under the username @budgetingrobynhas clearly caused a lot of surprise, as the video has quickly been viewed 17,900 times.

Social media users were grateful for Robyn’s advice, with many taking to the comments en masse to express their support.

Someone said, “Good advice.”

Another added: “I didn’t know we could use hashtags!”

While someone else commented: “I made £5,000 on Vinted. Amazing.”