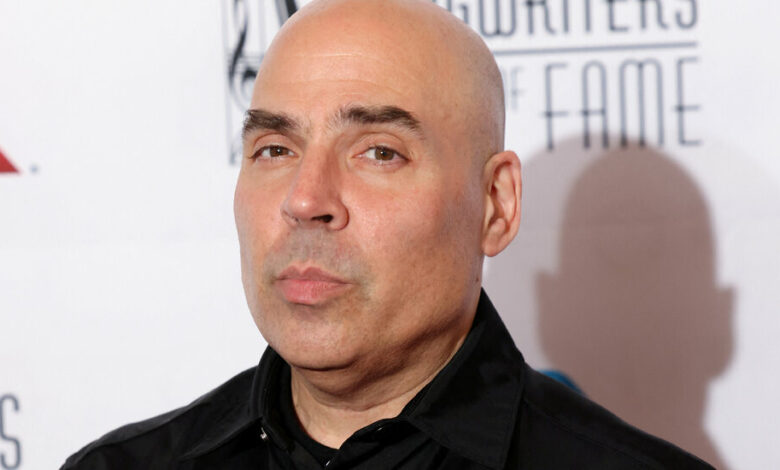

Music catalog giant Hipgnosis is sold and Merck Mercuriadis leaves

Six years ago, outspoken music executive Merck Mercuriadis sparked a new wave of deals in the music industry when his company Hipgnosis bought the song catalogs of artists including Neil Young, Shakira, Justin Bieber and the Red Hot Chili Peppers.

Now Mercuriadis, who once managed Beyoncé and Elton John, is stepping down from the company after its assets were sold to private equity giant Blackstone, following a tumultuous year that included a shareholder revolt, an accounting scandal and a bidding war.

In the company’s complex structure, Hipgnosis Songs Fund is an “investment trust” listed on the London Stock Exchange that owns the rights to tens of thousands of songs. A separate company, Hipgnosis Song Management, run by Mercuriadis, is the “investment advisor” and does much of the dealmaking and administration for those songs. In 2021, Blackstone invested $1 billion to gain majority control of the advisory firm.

The board of Hipgnosis Songs Fund voted on Monday accepted Blackstone’s $1.6 billion bid for the company’s assets, the company announced Tuesday morning.

After Hipgnosis went public in 2018, the company got off to a flying start. It began a spending spree for artists’ song rights that eventually totaled more than $2 billion. The company also made a high-profile pitch to investors, saying that its pop song royalties “more valuable than gold or oil.”

Mercuriadis also regularly attacked the corporate conglomerates that dominate the music industry, portraying them as owning too much content to manage it properly. Privately, others in the industry complained that Hipgnosis was paying too much for catalogs, causing prices to go up everywhere. In 2021 alone, the music industry had $5.3 billion According to an estimate by Midia, a firm that studies digital media and the music industry, many of these transactions stem from deals with individual artists.

“People see songs as inanimate objects; I don’t,” Mercuriadis told The New York Times in a 2020 interview. “I think they’re the great energy that makes the world go round, and I think they deserve to be managed with the same level of responsibility that people are.”

But last year, investors in Hipgnosis Songs Fund became unhappy with the company’s share price, which had fallen sharply, well below the value of its assets, as calculated by a third party.

In October, shareholders voted against retaining the company’s structure, leading to a series of changes, including a hard review by a new financial advisor, causing the value of the company’s assets to fall by 26 percent. The report also found that Hipgnosis Song Management had overpaid for most of its catalog and had overstated the fund’s revenues and profits.

In April, Hipgnosis Songs Fund reached a tentative deal to sell its assets to Concord, a large American independent music company whose portfolio includes labels such as Fantasy, Rounder and Loma Vista, for $1.4 billion. But a bidding war with Blackstone ensued, with Blackstone submitting the winning bid of $1.31 per share.

Last week, Mercuriadis announced that he would be leaving Hipgnosis Song Management once Blackstone had acquired the entire catalog.

“This is a good opportunity for me to make a strategic shift in focus,” he said in a rack“and to spend more time advocating for the interests of songwriters, to ensure they are properly compensated for their work.”