India

Tariffs and tensions will trump trade | India News – Times of India

And just as the Commerce Department in New Delhi hailed smooth ties with Washington, they will have to brace to ensure relations are not strained once Donald Trump walks into the Oval Office next January. called India the “biggest charger” of tariffs. In September, he called India a “very big (trade) abuser,” leaving the country and Brazil just below China.

The rhetoric is no different from that during his first term, when he called India “tariff king” and then raised tariffs on steel and aluminum by 10 to 25 percent, invoking national security provisions. The tariff impacted 2.3% of India’s trade with the US, and the government responded with retaliatory tariffs on almonds, apple lentils and steel after preferences were also withdrawn by the Trump administration. This time too, he has expressed his preference for “tit-for-tat” rates. “So we’re going to do a reciprocal transaction. If someone charges us 10 cents, if they charge us $2, if they charge us 100%, we charge the same,” Trump had said ahead of Modi’s US trip.

Trump does not believe in looking at the average rate or whether the levies are within the allowable limits. His attacks are political. “Trump could pressure India to cut tariffs and also impose higher tariffs on Indian goods, especially in sectors such as autos, textiles, pharmaceuticals and wines, which could make Indian exports less competitive in the US market” , said Ajay Srivastava of GTRI. India is not unique; Countries around the world impose high duties on sensitive products. With Trump’s return, they are preparing for new trade tensions.

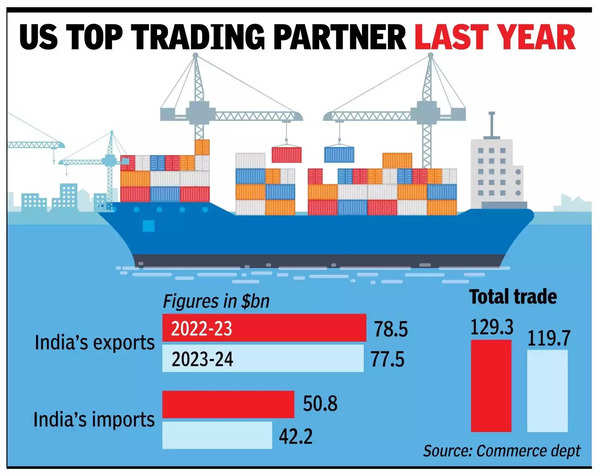

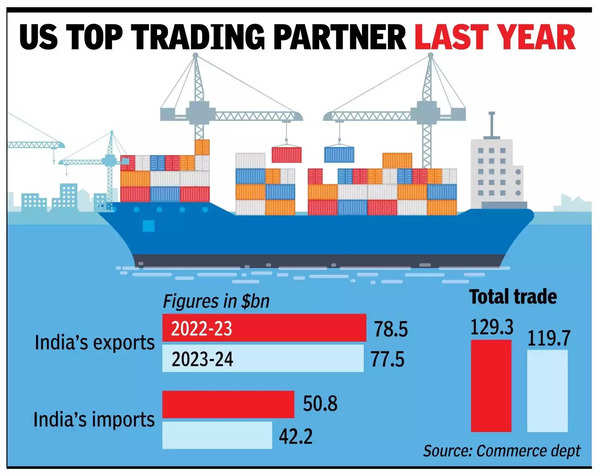

Given that the president-elect views China as the “toughest” and India as “the strongest,” the main focus of his actions will likely be on Beijing. Regardless, in 2023, China’s merchandise exports to the US were estimated at $427 billion – five times higher than India’s $84 billion. “It will come down heavily on China. If Trump increases tariffs on countries like India at a lower magnitude than China, the country will benefit,” said Jayant Dasgupta, India’s former ambassador to the WTO.

This could potentially open the doors to some Indian companies, provided they have the capacity to produce these goods. For example, the Biden administration’s tariff hikes on electric vehicles and semiconductors will bring virtually no profit to India.

With the dispute settlement mechanism at the WTO frozen by blocking all appointments to the appellate body, the multilateral agency is unlikely to take action in the next four years. However, a carefully constructed partnership can help India tap into the US hunt for crucial minerals and technology. The fate of forums like Indo-Pacific Economic Cooperation, a post-Covid platform to counter China, remains unclear under Trump.

But trade experts believe that Trump prefers bilateral agreements over multilateral or plurilateral agreements. That means he might be willing to make deals that bring profits to corporate America, at least to his constituency.