Biden’s Student Debt Relief Plan Blocked by Appeals Court. What SAVE Borrowers Need to Know

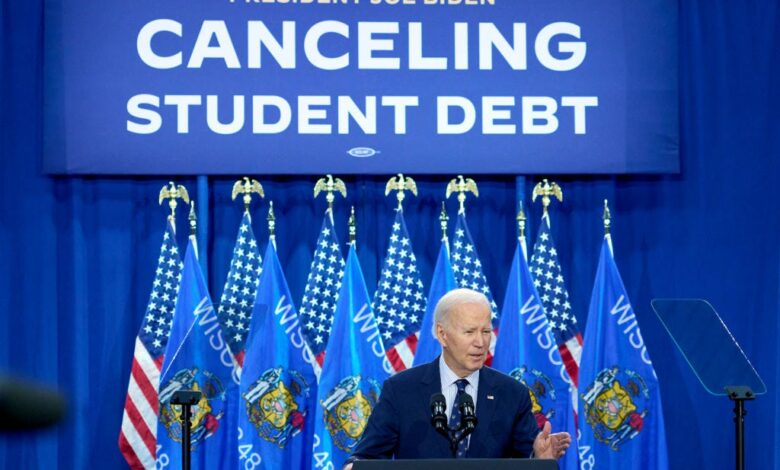

Daniel Steinle/Bloomberg via Getty Images

Key learning points

-

- On Thursday, the 8th Court of Appeals temporarily blocked all parts of the Biden-Harris administration’s SAVE plan that were not already on hold.

-

- This decision contradicts a temporary ruling by the 10th Court of Appeal in June, which allowed certain parts of the SAVE plan to go ahead.

-

- Both appeals decisions are in response to orders filed by federal judges earlier in June that temporarily halted parts of the SAVE repayment and debt relief plan.

-

- Payments for SAVE borrowers remain on hold for now while the courts review the White House’s income-based repayment plan.

President Joe Biden Saving on a valuable education plan was temporarily blocked by a federal appeals court on Thursday, the latest in a series of staggering rulings on the Biden-Harris administration’s latest student debt relief plan.

This decision comes weeks after the 10th Court of Appeal decided to allow parts of SAVE to continue.

“We now have two conflicting rulings from two different circuit courts that can only be resolved by the U.S. Supreme Court,” said financial aid expert Mark Kantrowitz and CNET Money Member of the Expert Assessment Committee“The U.S. Department of Education may have the ability to choose which court ruling to follow until the U.S. Supreme Court issues a ruling.”

Borrowers enrolled in SAVE have had their payments suspended since the beginning of the month while the Department of Education worked to recalculate their monthly student loan payments. As part of the next rollout of SAVE, borrowers expected their monthly payments to drop from 10% to 5% of their discretionary income.

Following Thursday’s ruling, the Ministry of Education has issued a rack saying that borrowers enrolled in SAVE would be placed in an interest-free forbearance program until further notice. This means that SAVE borrowers will not have to make monthly payments on their student loans until the courts resolve this issue.

“Borrowers enrolled in the SAVE Plan will be granted an interest-free forbearance while our government continues to vigorously defend the SAVE Plan in court,” said Secretary of Education Miguel Cardona. “The Department will provide regular updates to borrowers affected by these rulings in the coming days.”

What happens with the SAVE payment plan?

The White House’s SAVE plan has faced numerous obstacles over the past six months. Earlier this spring, Republican-led lawsuits were filed against the SAVE plan in Kansas and Missouri. JuneTwo federal judges filed injunctions against key parts of SAVE. The rulings temporarily prevented the Department of Education from moving forward with the next phase of the SAVE plan, which included reducing payments from 10% of a borrower’s discretionary income to 5%. New attempts at student loan forgiveness under the income-driven repayment program also were halted.

On June 30, the 10th U.S. Court of Appeals heard a case decided to allow (PDF) the Department of Education to continue reducing borrowers’ payments. However, Thursday’s ruling leaves the path forward for SAVE unclear, as it temporarily halted all elements of the government’s SAVE plan that had not already been blocked.

What should borrowers who have registered with SAVE do now?

If you’re enrolled in the SAVE repayment plan, you’re probably at a loss for what to do next — and for good reason. With two decisions that conflict, it’s likely going to take a higher court, the U.S. Supreme Court, to clear the air.

You can try to plan ahead based on what might happen. If you expected SAVE to release you from debt, be prepared in the event that the court rejects the plan. Monthly payments are currently suspended for all borrowers in the SAVE plan and will likely remain paused until a final decision is made. In the meantime, you can review your existing loan balance and estimated monthly payment so that you have an idea of how much you might owe when payments resume.

If the courts approve the SAVE plan, you can expect your payments to drop to 5% of your discretionary income — a step the Department of Education has been working to implement. If the debt forgiveness is also approved, you don’t need to do anything to apply for forgiveness through SAVE. You will be notified by the Department of Education when you meet the requirements for forgiveness.

Kantrowitz says to watch for new guidance from the Department of Education for the time being. He also reiterated that the current court rulings are temporary and not final.