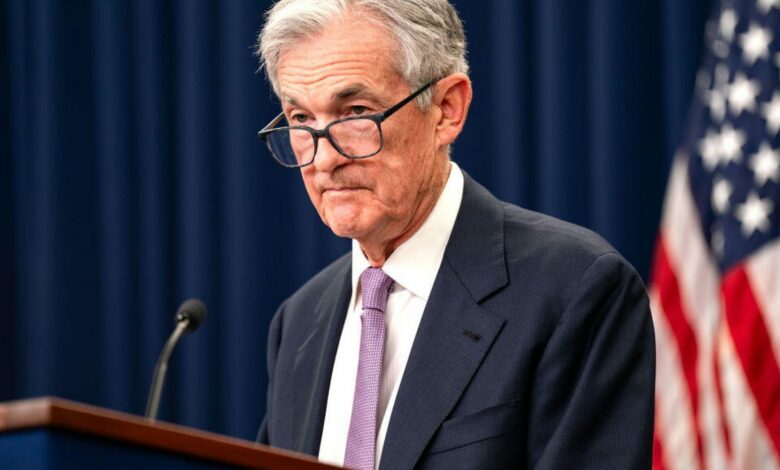

Due to the strong economy, the Fed is in no hurry to cut interest rates, says Chairman Powell

If you’ve been eagerly awaiting a flood of rate cuts, Fed Chairman Jerome Powell’s latest comments could derail your plans.

Following the Fed’s quarter-percent rate cut at its November meeting, experts are less confident of further cuts in the near term, amid continued reports of resilient consumer spending and mixed employment reports. Powell’s comments to business leaders in Dallas this week indicated that the Fed is in no hurry to tamper with a good thing.

“The economy is not showing any signs that we should rush to cut rates,” he said, calling the U.S. economy’s recent performance “by far the best of any major economy in the world.”

His comments came a day after Bureau of Labor StatisticsThe monthly consumer price index report showed inflation rose at an annual rate of 2.6% in October. While the report was in line with most experts’ expectations, it marked a reversal in the slow but steady decline in the inflation measure since this spring. According to the BLS report, homes continue to be the largest contributor to rising prices, accounting for half of the increase. The housing index rose by 0.4% month on month.

The latest inflation news could dampen hopes that the Federal Reserve will cut rates in December. After months of cooling inflation and signs of a weakening labor market, the Fed cut rates by half a percent in September and another quarter of a percent this month. The committee had planned another quarter of a percent interest rate cut in December, as well as further cuts in 2025.

But if inflation continues to rise, the central bank may decide that interest rates must remain high to avoid a recurrence of runaway inflation. Inflation peaked at 9.1% in June 2022, but slowly fell back towards the Fed’s target range of 2%.

The Fed does not directly set interest rates, but when it changes the federal funds rate, banks tend to follow suit. Interest rates affect how much it costs you to borrow money, including on mortgages and credit cards.

However, higher interest rates can also affect how much you can earn on your savings. That can help people who have even a small amount of money to put aside, says Bernadette Joy, a personal finance coach and member of the CNET Expert Review Board.

“Savings accounts and high-yield CDs still offer decent returns, so putting even a little extra aside can be a smart way to end the year,” she said.