How We Found the Best and Worst States for Solar Accessibility

When speaking with industry experts about potential barriers to transitioning to renewable energy, we often hear the term “solar accessibility” pop up during the conversation. We did some digging on each state’s solar policy (laws and legislation affecting solar panels in a state) to see how accessible residential solar actually is to most Americans.

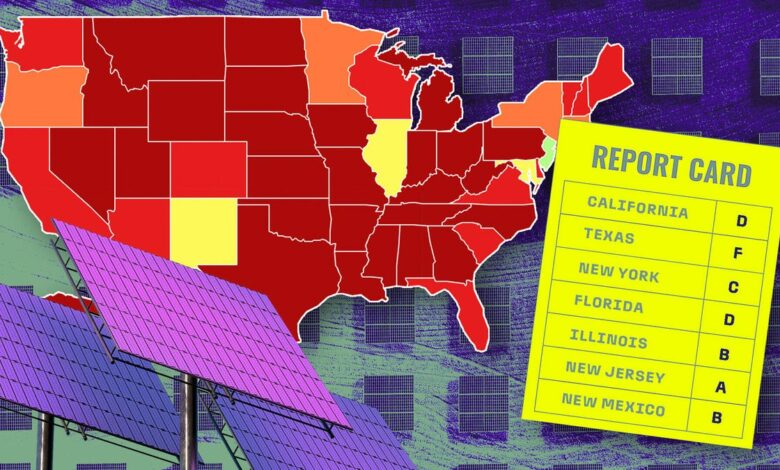

We decided to score and rank every state on how solar-friendly its solar policies are, where each is excelling and where each is lacking. To do this, we created a methodology with set grading criteria. States with better solar policy earn higher marks.

Here’s the process we used to score each state or territory.

Our methodology

We score each state based on eight categories, each with a weight. The higher the weight, the more of an impact we feel it has on your ability to go solar. We chose categories based on policies and incentives that apply to all or most of a state’s residents — like state tax credits, tax exemptions and net metering policies. States that make solar incentives accessible to all earn higher marks.

Here are our categories and weights:

- State solar tax credit (or equivalent incentive): 25%

- Net metering: 15%

- Property tax exemption: 15%

- Sales tax exemption: 10%

- Community solar policy: 10%

- Low-income solar program availability: 10%

- Renewable portfolio standards: 10%

- Total investment in solar per capita: 5%

How we score each category

Individual category scores are averaged to get the final score, which is converted to a letter grade. The original grading scale was on a traditional grade scale, but because the vast majority of states scored so poorly, we added a grading curve.

Here’s what the grading scale looks like:

Grading scale

| Final score | Grade received |

|---|---|

| 90 – 100 | A |

| 89 – 75 | B |

| 74 – 60 | C |

| 59 – 40 | D |

| Below 40 | F |

How we selected and scored our categories

A state’s solar policy (laws and legislation affecting solar energy) directly impacts the accessibility of residential rooftop solar. We focused on categories that have statewide impacts. The weight given to each category was determined by how big of an impact we think it has on consumer accessibility and affordability to residential solar.

We’ll break down what each category means, why it was selected and how we scored it.

State solar tax credit (or equivalent incentive)

Some states offer their own tax credits for residents who install solar panels on their property. These tax incentives are typically a state income tax credit, allowing you to claim a certain amount of money off the total cost of your solar panel system on your state taxes (up to a certain amount). If your tax liability for the year isn’t high enough, some states will allow you to roll the remaining amount over for a set number of years, or indefinitely. State solar tax credits can be stacked with the federal solar tax credit.

We found that one of the best ways states can show their commitment to residential solar is by offering a statewide solar tax credit. You don’t have to belong to a specific income bracket to qualify, although you may not get as much of a benefit if you don’t pay much in state taxes. However, some states do require a minimum solar panel system size to qualify, usually at least 5 kW or larger. As of August 12th, 2024, only eight states offer statewide solar tax credits. These states are Arizona, Hawaii, Idaho, Maryland, Massachusetts, New Mexico, New York, Rhode Island and South Carolina.

And while Illinois technically doesn’t offer a state solar tax credit, we felt as though their statewide solar incentives are a decent equivalent. We also took state SREC programs into consideration. States like New Jersey, Massachusetts and D.C. have robust SREC programs, making it possible to potentially earn thousands of dollars by selling your excess solar energy. We found this to be an incentive on par with state solar tax credits. But it should also be noted that navigating the SREC market can be complicated and you’ll likely need to go through a broker or third party to sell your SRECs.

State solar tax credit scoring rubric

| Score | Description |

|---|---|

| 5 | Tax credit of up to $20,000 or more |

| 4.5 | Tax credit offered is higher than $5,000, with roll over available or equivalent incentive available |

| 4 | Tax credit offered is higher than $5,000 (no roll over available) |

| 3.5 | Tax credit of up to $5,000 or less, with roll over available |

| 3 | Tax credit of up to $5,000 or less (no roll over available) |

| 2.5 | Tax credit of up to $1,000 or less, with roll over available |

| 2 | Tax credit of up to $1,000 or less (no roll over available) |

| 1.5 | Credit could be available, but information is unclear |

| 1 | No tax credit offered |

Net metering

Net metering allows you to sell excess electricity generated by your solar panels to your utility company. You’ll typically be compensated in the form of bill credits. The amount you’ll be compensated depends on your utility and your state’s net metering law. Most states have a statewide net metering policy, telling utilities what rate they must compensate their customers at for their net excess generation (NEG).

In most states, you’ll either be compensated at the full retail rate (the rate your utility charges for electricity), partial or a fraction of the retail electric rate or the wholesale/avoided cost rate (the rate at which your utility buys electricity from its generators). States that offer full retail rate compensation earn higher marks in this category.

Most states have a statewide net metering policy in place. However, some don’t. With no mandatory rules set in place, it’s up to the utility companies to decide the terms of their solar buyback programs, or if they even want to offer any. Alabama, South Dakota and Tennessee are the only states that don’t have a net metering policy.

Net metering scoring rubric

| Score | Description |

|---|---|

| 5 | State-governed net metering policy with full retail rate compensation |

| 4 | State-governed net metering policy with partial rate compensation |

| 3 | State-governed net metering policy with wholesale/avoided cost rate compensation |

| 2 | Utility-governed net metering |

| 1 | No statewide net metering policy or solar buyback programs available |

Property tax exemption

Solar panels are generally considered to be an “upgrade” to your home. And unfortunately, this could mean you’ll pay more in property taxes. To avoid this, some states offer a property tax exemption for solar panel systems, keeping you safe from a higher property assessment. This type of exemption typically applies statewide and is another way states can help make solar more accessible for its residents.

States that offer a full exemption earn higher marks. But if your state doesn’t offer a full ride, it can get a little tricky. Some states only offer an exemption on solar panel systems up to a certain amount of the assessed value, while some other states might offer a full exemption but it only lasts for a certain number of years. There are currently 37 states in the US that offer some sort of property tax exemption for residential solar panel systems. However, some are local exemptions only.

Property tax exemption scoring rubric

| Score | Description |

|---|---|

| 5 | Fully (100%) exempt |

| 4.5 | Exempt up to 60% or higher of assessed value |

| 4 | Exempt up to 59% or lower of assessed value |

| 3 | Exempt for 15 years or more |

| 2.5 | Exempt for less than 15 years |

| 2 | Local property tax exemptions only |

| 1.5 | Exempt up to a specific size solar panel system |

| 1 | No property tax exemption offered |

Sales tax exemption

There’s a sales tax charge for just about everything, including all the equipment and labor necessary for installing your solar panel system. Some states will offer a sales tax exemption on the cost of your solar panel system.

This could potentially save you hundreds. And while that might not seem like a lot in the grand scheme of things, it’s just one way for states to increase solar affordability for residents. If your state doesn’t charge sales tax, then your system is already exempt. There are currently 21 states in the US that offer some form of sales tax exemption for solar panel systems.

Sales tax exemption scoring rubric

| Score | Description |

|---|---|

| 5 | Fully (100%) exempt |

| 3 | Exemption offered, but with limitations (system size, only certain solar equipment, etc.) |

| 1 | No sales tax exemption for solar panel systems offered |

Community solar policy

Community solar is a great way for people who either can’t afford solar or can’t install solar on their property to power their home with solar energy. Instead of buying electricity from your utility, you’ll buy your electricity from a local solar farm. The rate you’ll pay is typically cheaper than the local retail electricity rate.

But not all states have community solar available, or even allow it. States that have community solar mandates in place (meaning the state requires a certain amount of community solar to be installed) earn higher marks in this category. However, we also award points to states that have community solar enabled. This means that community solar is allowed in the state, but there’s no requirement on installation capacity.

Community solar scoring rubric

| Score | Description |

|---|---|

| 5 | Community solar mandated |

| 3 | Community solar enabled |

| 1 | No community solar policy in state |

Low-income solar programs

It’s no secret that going solar is expensive, with systems costing tens of thousands of dollars. This puts low-income households that could really benefit from solar panels at a disadvantage. Our methodology rewards states that fund or administer solar programs specifically for those in lower income brackets.

States earn higher marks in this category if they offer state-administered or directed solar programs for low-income households. This could mean free or low-cost solar panels or a certain amount of installed community solar capacity for low-income homes. Some states have low-income solar programs, but they aren’t statewide. Instead, they might be offered by local nonprofits or utilities. We want to award a few points to those situations as well. We also wanted to reward states if they offer community solar carve-outs specifically for low- and moderate-income residents, allowing those people to access affordable solar energy.

Low-income solar program scoring rubric

| Score | Description |

|---|---|

| 5 | Low-income solar programs and community solar programs available statewide |

| 4 | Low-income solar programs or community solar programs available statewide |

| 3 | Local or utility-administered low-income solar programs and community solar programs available |

| 2 | Local or utility-administered low-income solar programs or community solar programs available |

| 1 | No low-income solar programs available in the state |

Renewable portfolio standards

Some states have laws in place telling utility companies that a specific amount of the energy they sell must come from renewable sources. This is called a renewable portfolio standard (RPS). States with higher RPS goals are more committed to furthering their renewable industries. But that doesn’t necessarily mean a state is going to be adding a bunch of solar capacity. We want to reward states on how solar-friendly they are, not just how big their renewable goals are.

This is where solar carve-outs come in. If a state’s RPS policy has a solar carve-out that means a certain percentage of the energy provided by electric utilities must come from solar specifically. Currently, only eight states in the US have a solar carve-out within their RPS. States with higher solar carve-out percentages earn higher marks in this category. But we also want to give a few points to states with substantial renewable energy goals.

Renewable portfolio standards grading rubric

| Score | Description |

|---|---|

| 5 | Solar carve-out is 10% or higher |

| 4 | Solar carve-out is 5% or higher |

| 3 | Solar carve-out is 1% or higher |

| 2.5 | RPS goal of 100% |

| 2 | Solar carve-out is less than 1% |

| 1.5 | RPS goal of 50% – 99% |

| 1 | State has no solar carve-out or RPS goal is below 50% |

Total investment in solar per capita

The amount of money invested in a state’s solar industry helps show the value and maturity of the state’s solar industry. The higher the value, the higher the likelihood of some of that money going toward the accessibility and affordability of solar panels in the state.

We took each state’s total investment in solar, according to data from the Solar Energy Industries Association, and divided it by state population data from the US Census Bureau. This gives a hypothetical view of how much of each state’s investment could go to each individual resident.

Total investment in solar per capita scoring rubric

| Score | Description |

|---|---|

| 5 | Investment per capita is $2,000 or higher |

| 4 | Investment per capita is $1,999 – $1,000 |

| 3 | Investment per capita is $999 – $500 |

| 2 | Investment per capita is $499 – $100 |

| 1 | Investment per capita is $99 is lower |

What we didn’t consider in our methodology

We wanted our methodology to focus on statewide policies and incentives, so we didn’t factor in any solar policies or incentives that only affect local areas. Many utilities offer energy efficiency rebates to customers within their service area. And it would be extremely difficult to account for every utility rebate offered for solar across the entire country. However, if you’re interested in going solar, we highly recommend doing some research on what types of local incentives are offered in your area. A reputable installer should be familiar with any incentives you may qualify for.

We also excluded any federal solar incentives, like the federal solar tax credit and the Rural Energy for America Program, from our scoring. These incentives are available to everyone in the country, regardless of what state you live in.