I did a ‘dossers’ diploma so I could use a student loan to pay for a £7,000 new kitchen

A STUDENT has told how she obtained a ‘dossers’ diploma so she could use the loan to pay for her new £7,000 kitchen.

She was still able to claim benefits and now owes the government £60,000, Erica Crompton reveals…

AT the ripe old age of 44, I decided to return to the classroom.

However, they were not the qualifications I was looking for.

My gamble was to find a ‘dossersdiploma’ with the lowest costs and use the remainder of the loan to have my kitchen renovated.

When I did the distance learning Masters in Creative Writing at Teesside University, I was able to do just that.

Most of my student friends ended up with their nice diploma in 2002 and had to take out all kinds of loans to pay for it.

At the time, master’s degrees were paid for by banks; they borrowed tens of thousands of euros at high interest rates that had to be repaid almost immediately after graduation.

Nervous about debt and finding work, I postponed my master’s degree, luckily enough with my two-year Foundation Degree in Journalism and not quite graduating with a three-year degree.

But when the lockdown came, I was ready to re-enter the education system and join my friends in MA-ville.

Government student loans have improved over the past decade – as it stands you can now get a £12,471 loan for a year’s full-time master’s degree, which means I can afford it.

Many courses are remote and to pass mine and receive my credit in Creative Writing, I only spend a few hours a week on it.

My kitchen cost £7,750 at Wickes and my course fee was only £3,750.

I have reported this to the Department for Work & Pensions (DWP). They made it easy – all I had to do was answer a Q&A over the phone about my course and how much the fees and loan were.

I also claimed Universal Credit as someone who was unable to work due to illness or disability such as my own, schizoaffective disorder.

If, like me, you have Universal Credit, you will need to report the loan as income and then reduce your monthly payments slightly.

Although my UC payments fell by a few hundred pounds a month, I was ultimately better off with the excess tuition costs.

I have also worked a few day shifts as a carer, which has increased my income by £103 per month to £1,100.

This isn’t the first time I’ve relied on my student loans to cover living expenses.

I struggled with psychosis for most of my twenties and couldn’t hold down a job due to paranoia.

My journalism degree was a good way to fill a gap on my CV, gain a qualification, but also – to pay my rent in London.

The next step for me is the PhD… increasing my debt to a nice €100,000

Erica Crompton

During my studies I took a Saturday job at the Fashion & Textile Museum.

However, I left after six months after struggling with my mental illness. Luckily, my student loan almost tied me down to study in London.

My grades for this course were poor due to poor attendance – at that time I could not leave my apartment due to my symptoms.

These days I’m in a much better place and work from home a bit and mostly stay home per doctor’s advice to ‘take it easy’.

How the different student loan plans work

HERE ARE the rules and repayment thresholds for all the different student loan plans:

Plan one

You use Plan 1 if you:

- an English or Welsh student who started a bachelor’s degree somewhere in Great Britain before September 1, 2012

- a Northern Irish student who commenced an undergraduate or postgraduate course anywhere in Great Britain on or after 1 September 1998

- an EU student who started a bachelor’s degree program in England or Wales on or after 1 September 1998, but before 1 September 2012

- an EU student who commenced an undergraduate or postgraduate course in Northern Ireland on or after 1 September 1998

You only repay if your income is higher than € 382 per week, € 1,657 per month or € 19,895 per year (before tax and other deductions).

Plan two

You use Plan 2 if you:

- an English or Welsh student who started a bachelor’s degree somewhere in Great Britain on or after September 1, 2012

- an EU student who started a bachelor’s degree program in England or Wales on or after 1 September 2012

- someone who has a Advanced Student Loan on or after August 1, 2013

You only repay if your income is higher than €524 per week, €2,274 per month or €27,295 per year (before tax and other deductions).

Plan four

- a Scottish student who commenced an undergraduate or postgraduate course anywhere in Great Britain on or after 1 September 1998

- an EU student who commenced an undergraduate or postgraduate course in Scotland on or after 1 September 1998

You only repay if your income is higher than €480 per week, €2,083 per month or €25,000 per year (before taxes and other deductions).

Postgraduate loan

- an English or Welsh student who took out a postgraduate master’s loan on or after 1 August 2016

- an English or Welsh student who took out a Postgraduate Doctoral Loan on or after 1 August 2018

- an EU student who started a postgraduate course on or after 1 August 2016

If you have taken out a Masters Loan or a Doctorate Loan, you will only repay if your income exceeds £403 per week, £1,750 per month or £21,000 per year (before tax and other deductions).

Today, most fees for undergraduate courses are set at £9,250, which the Student Loans Company (SLC) covers.

You can also access a ‘maintenance loan’ via the government website (scroll down for more details). You must provide details of your household income and the start date of your course.

The loan is paid directly into your bank account at the start of each term, while you will have to repay the loan, but only if you earn above a certain amount: the threshold salary which starts at £24,990 per year.

The government says that if you are doing distance learning, you can only apply for a Maintenance Loan if you are unable to attend the course in person due to a disability.

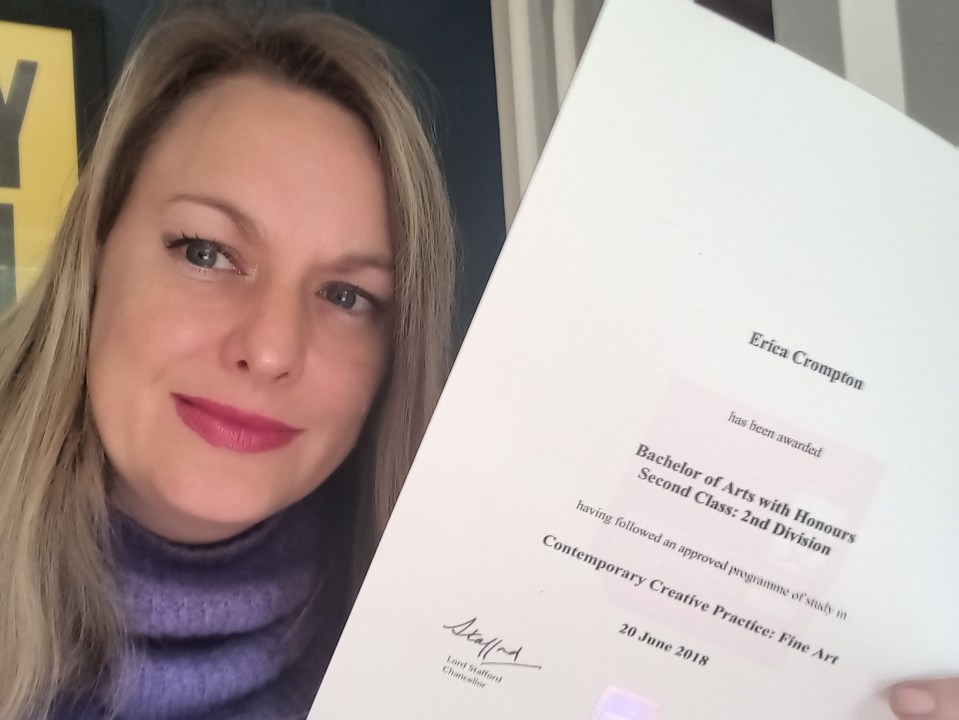

In 2017 I realized I could still get a loan for the third year of a BA (Hons), which you don’t do with a Foundation Degree like mine.

The best way I could do that was to do a ‘top-up’ BA(Hons) in Fine Arts locally at the University of Staffordshire, where I could still claim Employment and Support Allowance of around £440 per month .

I even rewrote and self-published my students’ essays and made a little pocket money by selling them through Amazon’s self-publishing program.

However, it is important to remember that it is not ‘free money’.

My family are in despair at how long I have been living on these types of student loans – I have over £60,000 in student debt from the SLA.

However, it is a comfort that is not reflected in credit ratings or mortgage applications. In fact, if it is not paid off at retirement, it will be canceled.

The next step for me is the PhD! I could do my thesis on the art of rushing and increase my debt to a cool 100,000 euros – what do you think?