I matched with a US Army colonel – harsh reality revealed later £10,000

A SINGLETON has bravely told how a potential love interest turned out to be one of the biggest mistakes of her life – a mistake that cost her a whopping £10,000.

Online scams have been around for a while, but now sick scammers are tricking unsuspecting people out of their savings by using fake images and even voices to lure their victims.

These technological advances make it easier to pull off a romance scam and harder to spot one — and those who fall victim will often choose not to report the elaborate crime due to shame and embarrassment.

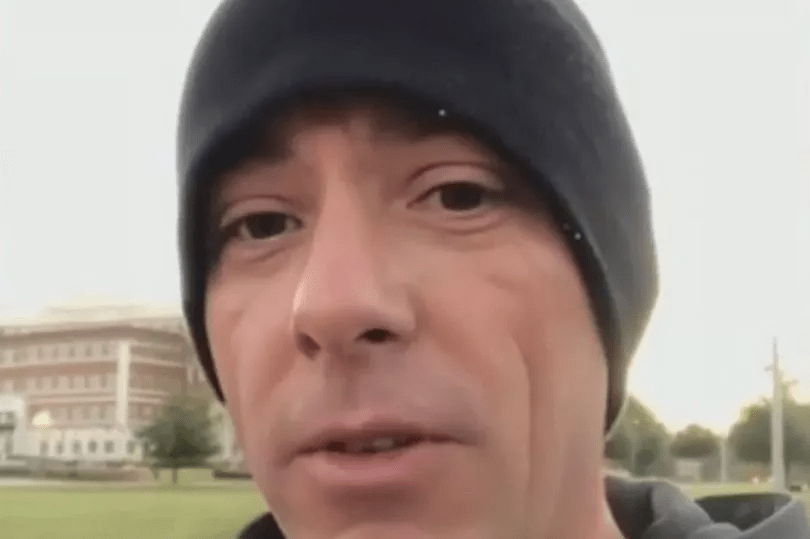

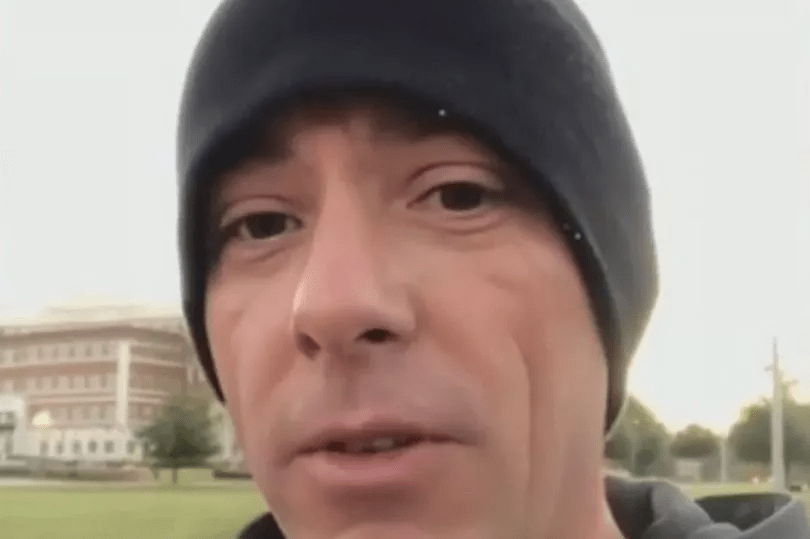

”Mike Murdy” is one such AI con artist: a dark-eyed US Army colonel whose profile claims the man is looking for love.

Mike is one of many new generation internet scammers. He is 61 and from Nashville.

According to the false information on the popular dating app Tinder, Mike is about to retire and plans to move to Cuba where he will start a new life with his partner.

read more about relationships

Mary, a caregiver who has been single for more than 20 years, shared The mirror how she found a match with the charming guy online.

”He said he was an army colonel stationed in Britain.

“He sent me a video dressed in his uniform. He looked quite handsome.”

The two singles started messaging around October and Mike also sent her a photo of what he claimed was of him and his late wife, who sadly died of cancer five years ago, saying he had no children or family.

At some point, Mary also gave him her address – and just a few days later, a box containing trinkets and souvenirs arrived on her doorstep.

A card sent to her read: “You are the one I want to be with, now and forever.”

In perhaps the cruellest part of the deception, the sick scammers enticed the woman’s help, claiming that Mike had a life insurance policy worth a whopping £607,000 from his late partner and needed help cashing in on it.

Using the messaging app Signal, the Colonel gave Mary a bank account number and sort code.

The suitcase arrived with an accompanying letter stating that it was from “111 E Chaffee Ave, Fort Knox, Kentucky, United States”.

The briefcase was waiting for delivery at a post office, but she had to pay some fees before she could receive it.

“Please trust me on this. Let’s make this happen so we can enjoy our retirement together,” he told her.

To gain access, Mary had to obtain a six-digit passcode, which was generated after receiving a £10,000 payment.

How to protect yourself from scams

BY keeping these tips in mind, you can avoid getting involved in scams:

- First, remember that if something seems too good to be true, it usually is.

- Check if brands are “verified” on Facebook and Twitter pages – this means the company has a blue checkmark on its profile.

- Look for grammatical and spelling errors; fraudsters are notoriously bad at writing correct English. If you receive a message from a “friend” informing you of a free copy, consider whether it is written in your friend’s normal style.

- If you’re invited to click on a URL, hover your mouse over the link to see the address you’re going to. Does it look real?

- To be safe, don’t click unsolicited links in messages, even if they appear to come from a trusted contact.

- Also, be careful when opening email attachments. Fraudsters are increasingly adding files, usually PDFs or spreadsheets, that contain dangerous malware.

- If you receive a suspicious message, report it to the company, block the sender and delete it.

- If you think you have been tricked, report it to Action Fraud on 0300 123 2040 or use online fraud reporting tool.

‘Mike Murdy’ assured her that this one final payment would unlock the suitcase – so Mary sent the eye-watering sum in late October, but a code to unlock the suitcase never arrived.

Mary broke into the suitcase, where she found only sheets of paper.

Mary said: “It’s really scary to think the fraudsters have just made these videos. I have never been scammed like this in my life.

‘I saved that money to redecorate my house. Now I don’t feel safe.”

Under new rules from the Payment Systems Regulator (PSR), banks are required to refund victims of ‘authorized push payment’ fraud, where people are tricked into transferring money to criminals.

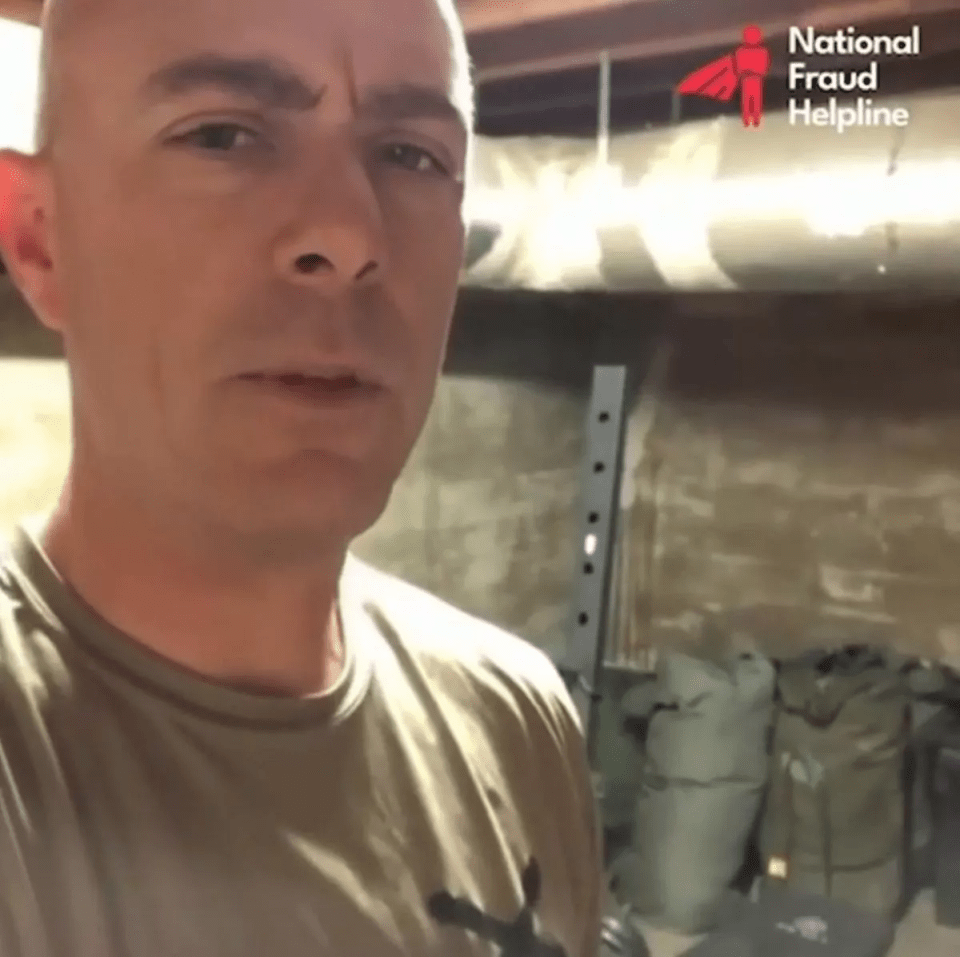

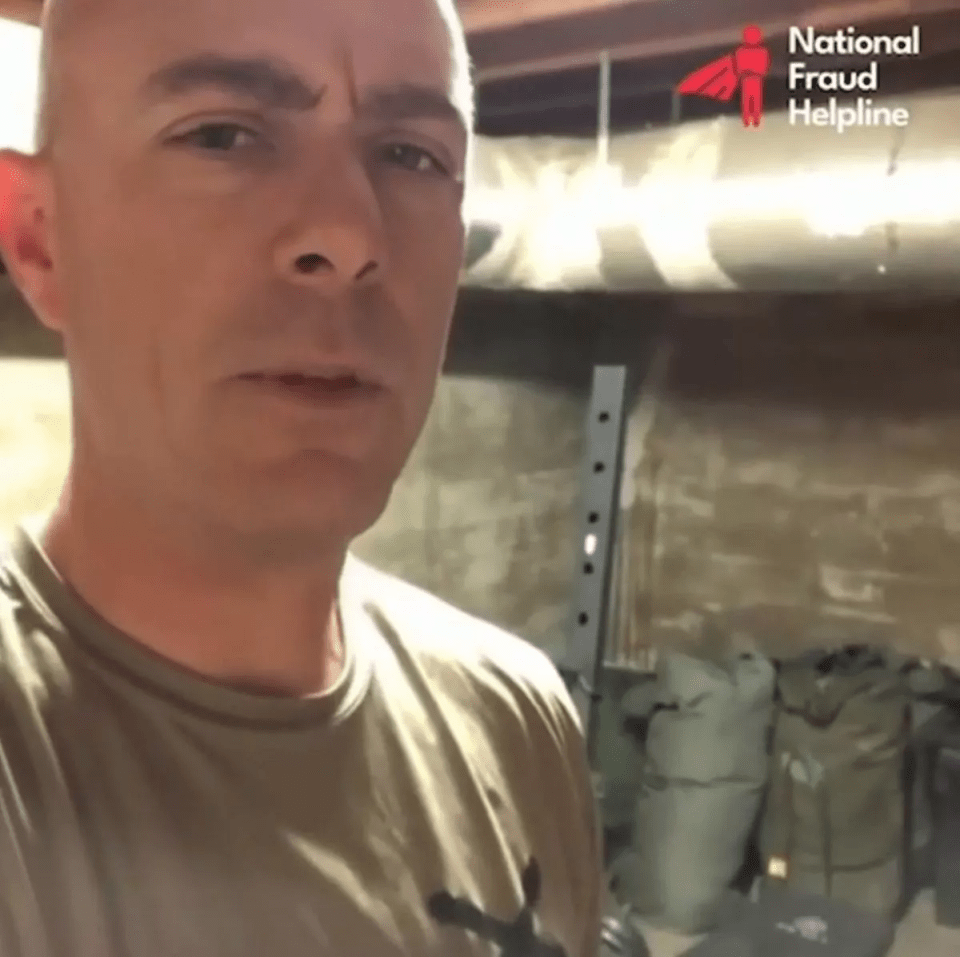

Martin Richardson, a senior partner at the National Fraud Helpline, said: “This was an incredibly unusual fraud where the scammer used all possible methods to convince the victim it was genuine.

”The fraudster not only created AI videos, but he also sent physical items such as the suitcase, trinkets, souvenirs and an ornament.

“Combining AI and… sending items through the mail is a testament to the level of sophistication of a very determined scammer.”

A Halifax spokesperson said: “Helping customers protect against fraud is our priority and we have deep sympathy for the victim of this crime.

“We are assessing the claim in accordance with the PSR rules on reimbursement and will confirm the outcome to our customer early next week.”