It’s not a real job. It’s an employment fraud

Imagine you’ve been looking for a job for months, and finally you get an unsolicited message from a recruiter. They offer a work-from-home position on the spot, making thousands of dollars a day. All you have to do is fill in a form with your personal details or, in some cases, pay for a starter package.

Sounds too good to be true? It is.

These types of offers are usually employment fraud. They may not always look like it, but job fraud generally aims to force you to spend money that you will never get back, or trick you into giving up personally identifiable information in order to steal your identity.

It can be difficult to distinguish them from legitimate job postings. Here’s how to determine if a job offer is legitimate or just after your money.

Read more: Work identity theft is more common than you think

How job fraud works

Job fraud can take many different forms depending on the end goal, and virtually anyone can be a target. Criminals pose as a recruiter, business owner, or hiring manager to advertise fake jobs or vacancies for nefarious purposes. In some cases fraudsters will set up bots to target people who have posted on LinkedIn about their layoff or ‘OpenToWork’.

More than 110,000 business and employment scams were reported to the Federal Trade Commission in 2023, according to a Federal Trade Commission report. February 2024 report, with losses reaching $491 million.

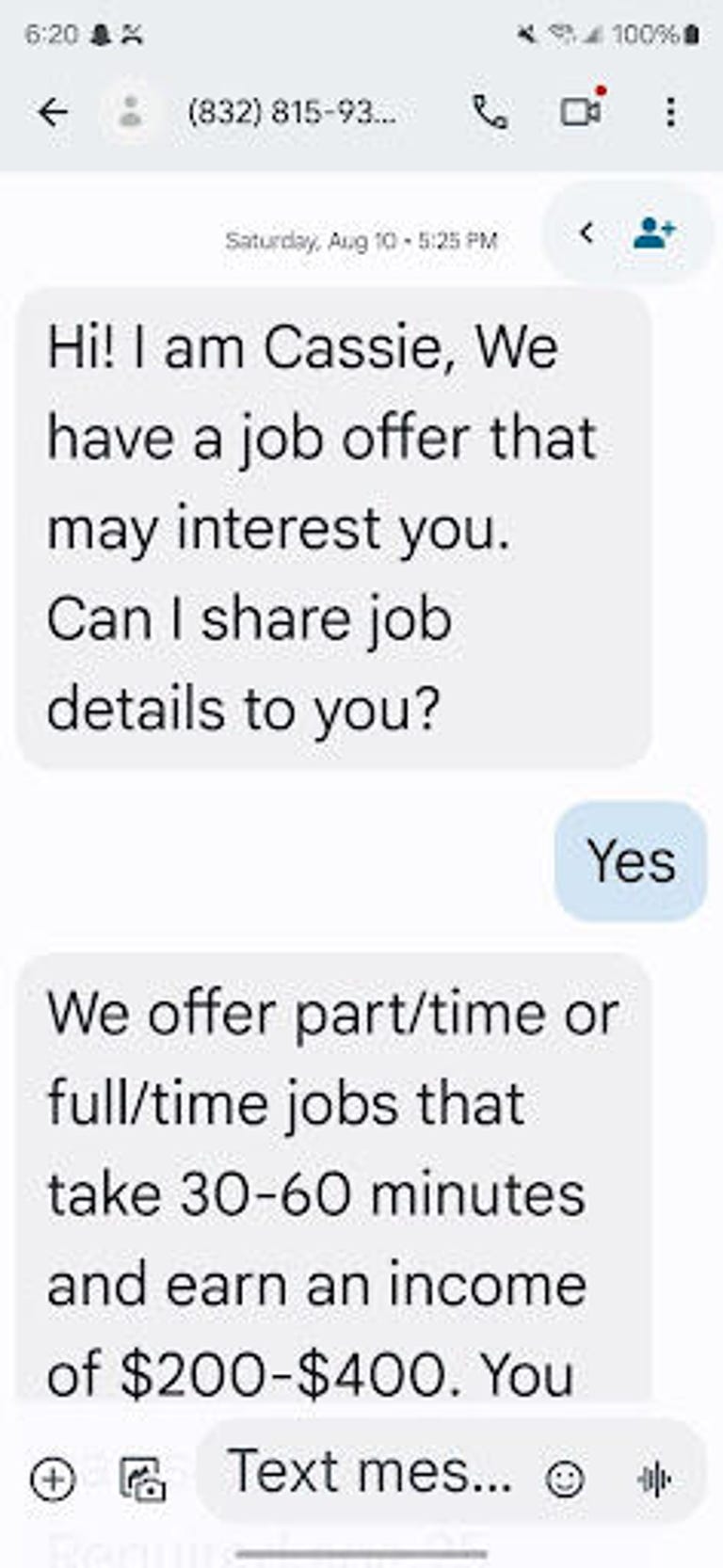

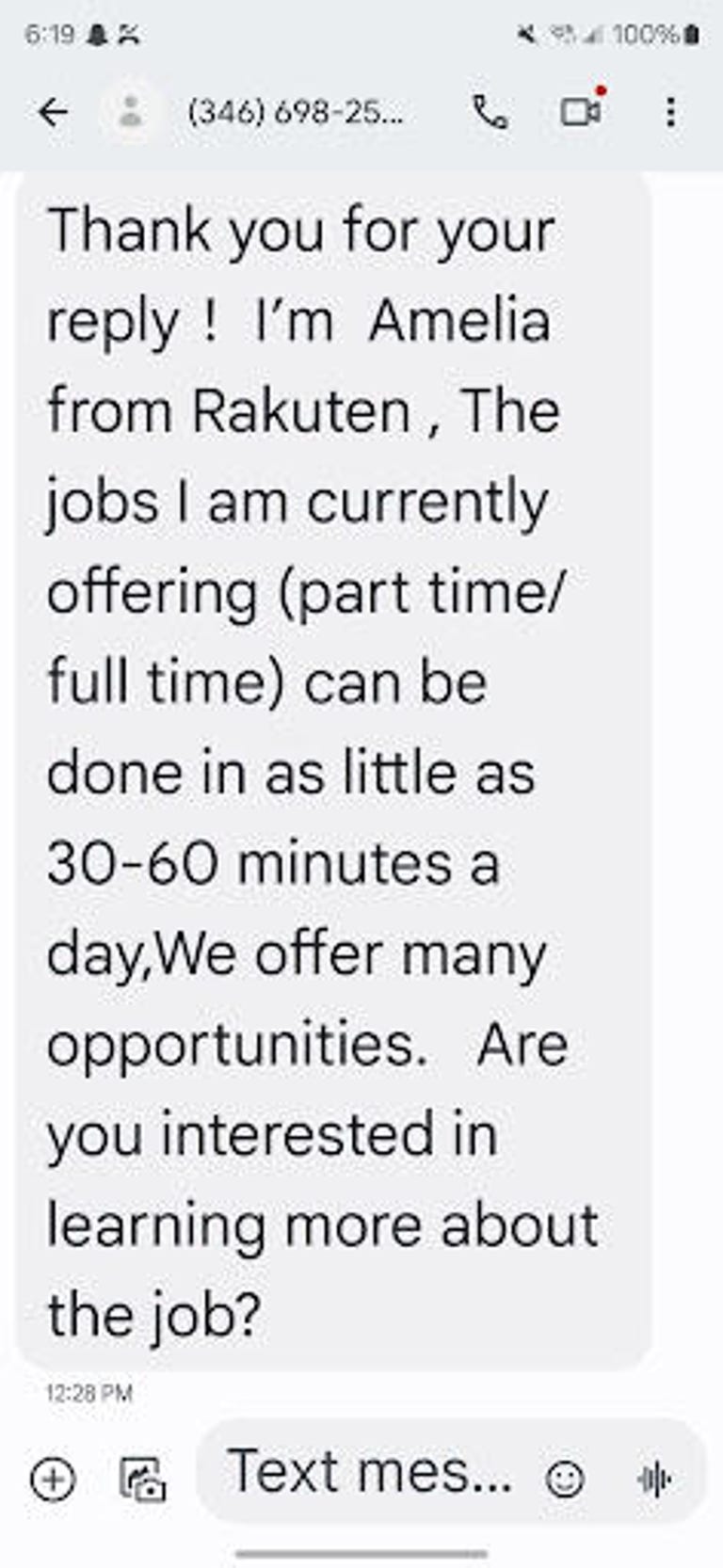

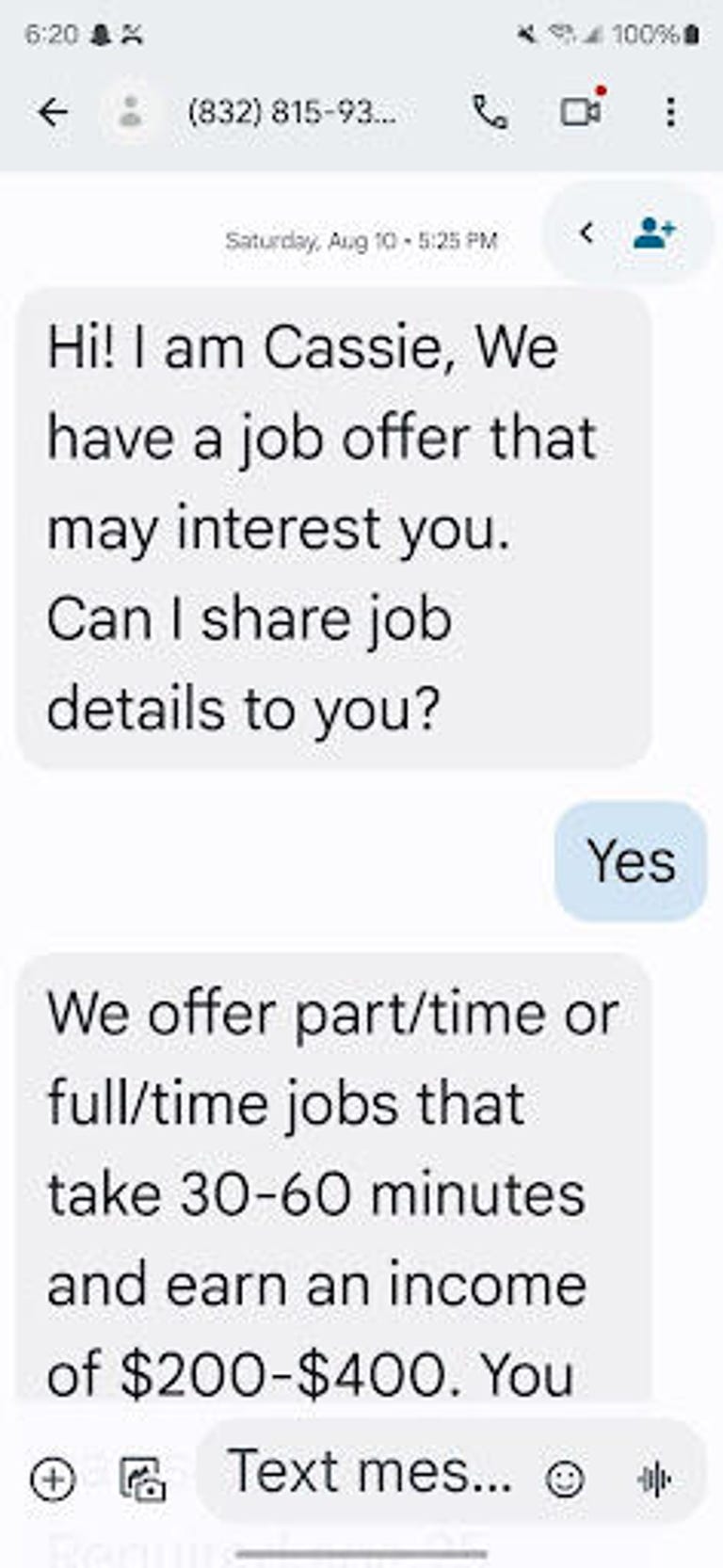

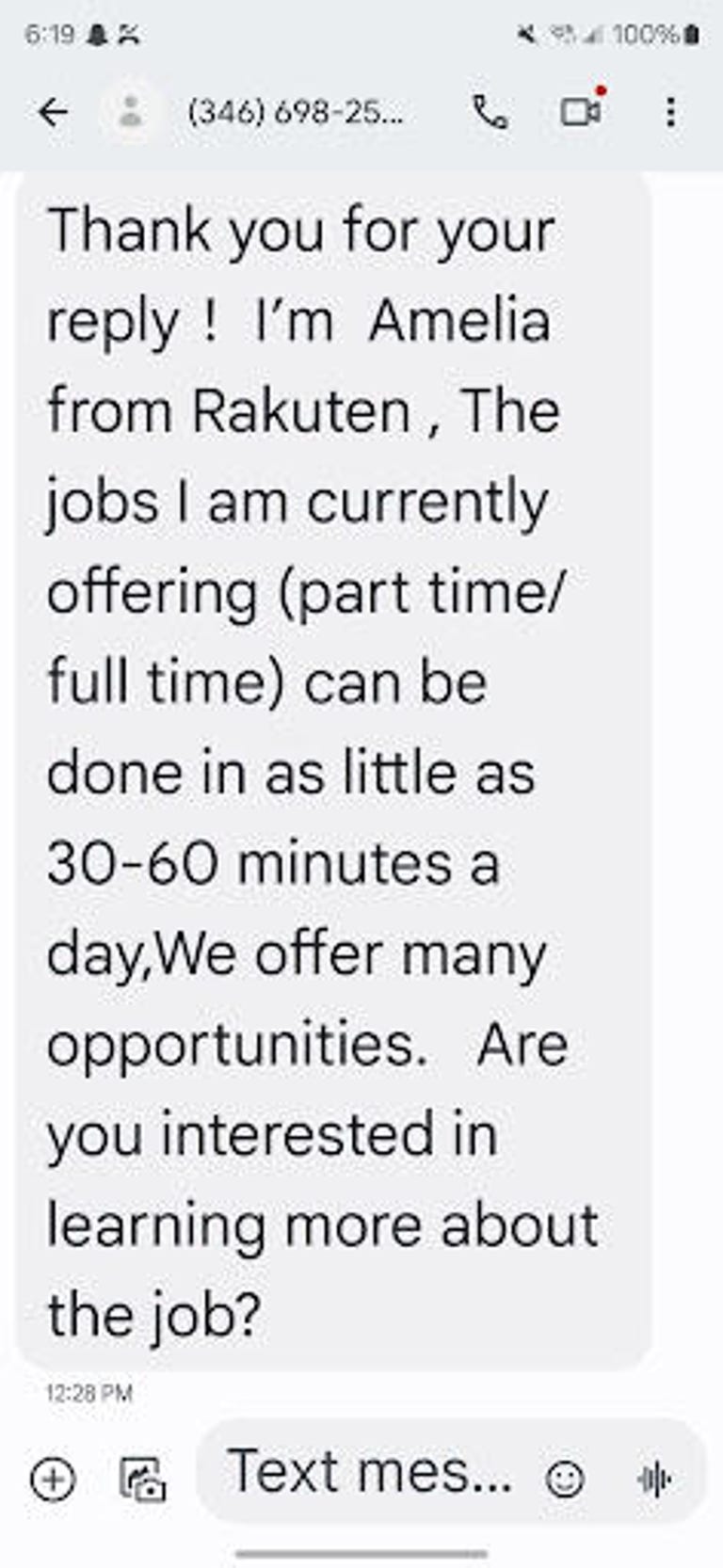

Individuals may receive seemingly untargeted text messages about available jobs. These texts are easy to ignore for those who are not looking for a job, but people who are currently looking for a job can easily assume that the texts are related to their search.

These are examples of unsolicited text messages I have received in recent months.

I replied to the first message (on the left) to see what they would say, knowing it was a scam. The person responded by arranging an interview via WhatsApp, but I never showed that.

The FTC warns that some fake job scams promise work-from-home opportunities where you can earn thousands of dollars on your own time. But these scams only exist to trick desperate people into buying expensive ‘starter packs’ for what they think is their new business venture.

Resending options are yet another popular job scam. This involves the victim agreeing to receive packages at their home, which they in turn repackage and send to a different address. The products themselves, often electronics, are likely purchased with stolen credit cards, and before you know it, you’re in the middle of a bigger scam. The check you are promised for helping ship products never comes either.

For more examples of recent scams, please visit the website Better Business Bureau scam tracker. Type “job” or “employment” into the search bar to view thousands of different employment fraud complaints, including details about how they operated and the amount of money lost.

How to avoid online job market scams

Employment scams can be difficult to identify or spot, especially if you are looking for work and want to believe that any bites from an employer are legitimate. But there are some telltale signs that should set off alarms in your mind.

These steps can help you spot fake job opportunities offered by scammers:

- They contact you via text message. Unless you know the recruiter, this is suspicious activity.

- The recruiter needs money up front. No legitimate company will require you to pay to work. If a job asks you to pay a fee or send money for equipment, that’s a scam, even if they say you’ll be compensated.

- The compensation is too good to be true. You have an idea of what a job should pay. If the salary is way above your own expectations, that’s a warning sign.

- The interview is conducted via a messaging service. Many job interviews are conducted remotely. But normally they are conducted via phone or video conferencing software, such as Zoom or Google Meet.

- You will receive an offer immediately. Finding a job can take some time, as multiple interviews are often required. Recruitment companies will also speak to and vet multiple candidates.

If you’re still unsure, the FTC recommends researching companies offering you a job to make sure they are legitimate. Also search for the company name followed by words like “scam” or “review” to see what comes up.

If you want to confirm a job opening or offer with a legitimate company, disable the recruiter and contact them directly.

Can job fraud lead to identity theft?

Some employment scams exist to steal money from victims, but others may not stop there.

During the job application process, victims can share information that is standardly required to be provided to a new employer, such as their name, date of birth, home address and social security number. This information can be used by identity thieves to open bank accounts, take out loans or credit cards in your name, and even file fraudulent tax returns.

As a safety measure, consider freezing your credit with the three major credit bureaus if you fall into a job scam. You may also consider signing up for identity theft protection. These services provide insurance to help pay necessary costs if your identity is stolen.

How to report job market scams

If you come across a fake job offer or scam, report it so others don’t fall victim to it. Here’s how:

If you’re already a victim of employment fraud, you’ll want to take some additional steps to limit the damage and protect yourself from identity theft.

For example, if you shared sensitive personal information as part of the scam, you can freeze your credit reports or set fraud alerts on your credit reports. You can also sign up for identity theft protection and monitoring services, which can alert you if someone tries to open an account or apply for a loan in your name.

If you have already sent money to a scammer, the FTC recommends that you contact the company behind the payment method you used (e.g. PayPal, Zelle, a credit card, etc.) to report the fraud and ask them reverse the transaction. In most cases you are unlikely to get your money back, but you won’t know until you ask.