Jeff Bezos loses $15 billion in one day, leading to a massive $134 billion drop in stocks for the world’s 500 richest people, including Mark Zuckerberg and Elon Musk

Jeff Bezos lost $15 billion of his fortune in one day after stock prices plummeted and the world’s 500 richest people, including Mark Zuckerberg and Elon Musk, lost a total of $134 billion.

Shares of Amazon.com Inc fell 8.8 percent on Friday as part of a broader market sell-off, according to BloombergThis caused Bezos’ net worth to drop to $191.5 billion, as his wealth was invested in his company.

Bezos has repeatedly sold shares of Amazon this year. In February, he sold $8.5 billion worth of stock and announced plans to sell another $5 billion worth of shares, which would still leave him with 912 million shares, or 8.8 percent of the stock.

The tech index Nasdaq 100 fell by 2.4 percent, which also affected billionaires such as Mark Zuckerberg and Elon Musk, who are on the list of the 500 richest people in the world.

Shares of Zuckerberg’s Meta Platforms Inc fell 1.9 percent, causing him to lose more than $3 billion in value. Musk’s net worth also fell by $6.6 billion, as his Tesla shares fell 4.2 percent.

Shares of Amazon.com Inc fell 8.8 percent on Friday as part of a broader market sell-off, according to Bloomberg. With Bezos (pictured) owning 912 million Amazon shares, or 8.8 percent of the stock, Bezos’s net worth fell to $191.5 billion.

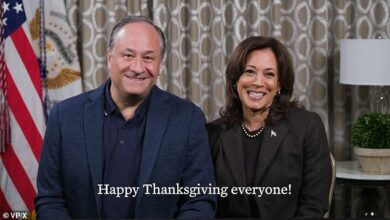

Zuckerberg’s (left) Meta Platforms Inc shares fell 1.9 percent, losing more than $3 billion in value, while Musk’s (right) fortune also fell by $6.6 billion as his Tesla shares fell 4.2 percent.

Friday’s $15.2 billion loss is Bezos’ third-biggest defeat ever, after his fortune shrank by $36 billion following his April 2019 divorce and Amazon shares fell 14 percent in April 2022.

Amazon’s recent share decline comes after the company said it would continue investing heavily in AI, despite fears from investors across the sector that AI’s gains this year have been overblown.

Other Fortune 500 billionaires include Oracle Corp’s Larry Ellison, whose fortune fell by $4.4 billion, and tech billionaires Sergey Brin and Larry Page, who each lost more than $3 billion.

The fallout from Friday’s Nasdaq index drop was still being felt Monday, as stock markets around the world continued to fall on fears that the U.S. economy is heading for a recession, while Japan suffered its worst sell-off since “Black Monday” in 1987.

According to experts at investment bank Goldman Sachs, the chance of a recession in the US is now as high as 25 percent. That is ten percent more than their previous estimate of 15 percent. JP Morgan, however, estimates the chance of a recession at 50 percent.

U.S. stock index futures fell sharply on Monday, with futures tied to the Nasdaq down nearly 4 percent. However, traders are now increasingly betting that the Federal Reserve will announce an emergency interest rate cut in response to the global stock market crash and to prevent a massive recession.

The sell-off followed the release of a dismal unemployment report last week.

Employers added just 114,000 jobs last month, according to data released Friday by the Labor Department, well short of the Dow Jones estimate of 185,000.

The figure was the lowest since December last year and the second lowest since the start of the Covid pandemic in March 2020.

This comes after the US Federal Reserve decided on Wednesday not to cut interest rates from 5.25 percent to 5.5 percent, which had been frozen since July last year.

Investors are worried that the Federal Reserve may be too late in supporting the fragile U.S. economy, warning that a U.S. recession would cause chaos in other economies around the world.

According to Bloomberg, the Federal Reserve’s rate cuts and some notable earnings disappointments have helped push the Nasdaq index into correction territory.

As a result, more than $2 trillion in value has been lost over the past three weeks.