Mortgage Rate Forecasts for the Week of August 5-11, 2024

While interest rates remained unchanged last week, the Federal Reserve’s next move could be to cut them. Last week, Fed Chairman Jerome Powell stressed that incoming economic data will influence when the central bank decides to cut interest rates.

On Friday, July Labor Report showed that job growth slowed more than expected, rekindling recession fears. The unemployment rate rose to 4.3% from 4.1%, the highest since October 2021.

Bad economic data usually means good mortgage rates, which tend to follow the movement of long-term bond yields (specifically the 10-year Treasury). After the most recent labor report, yields on the 10-year fell sharply and mortgage rates fell.

Barring a significant increase in inflation, experts are now predicting an even bigger rate cut at the September meeting: a half percentage point or more, rather than a quarter percent cut. A second cut before the end of the year is also more likely. Those who have been waiting for lower mortgage rates, whether to buy a new home or refinance an existing loan, should finally see some relief.

Will mortgage rates fall in 2024?

The average rate on a 30-year fixed mortgage is 6.75% today, according to data from Bankrate, CNET’s sister site. Since last week, average rates have decreased by 0.12%.

When the Fed starts cutting interest rates, mortgage lending rates will also fall. Most economists and housing experts expect the average rate on a 30-year fixed mortgage to fall by about half a percent by the end of the year.

A single rate cut will not bring mortgages down immediately. Instead, the cumulative effect of cooling inflation and a series of rate cuts over the coming period could make home ownership more affordable in the long run.

“I think 6.5% is a reasonable target for early 2025,” says Erin Sykesfounder of real estate company Sykes Properties. In the long term, Sykes thinks mortgage rates will end up around 6%, marking a healthy balance between the extreme low-high swings we’ve seen since 2020.

Will the Fed Cut Rates in September?

The Fed has three remaining policy meetings in 2024 (Sept. 17-18, Nov. 6-7, and Dec. 17-18). Since the Fed typically does not adjust interest rates too close to a presidential election, it is unlikely that we will see major monetary changes at the November meeting.

According to Sykes, September would be the last chance to make cuts before election day.

For the Fed to cut rates, there would need to be continued progress on inflation and further weakening of the labor market (i.e., higher unemployment). The latest jobs report could prompt the Fed to change its outlook and make a deeper cut at its September meeting, or even an emergency cut before then.

It could also affect how many rate cuts the Fed makes this year. The central bank’s latest Summary of Economic Projections projects just one rate cut in 2024, but it could be forced to cut rates twice to avoid a recession.

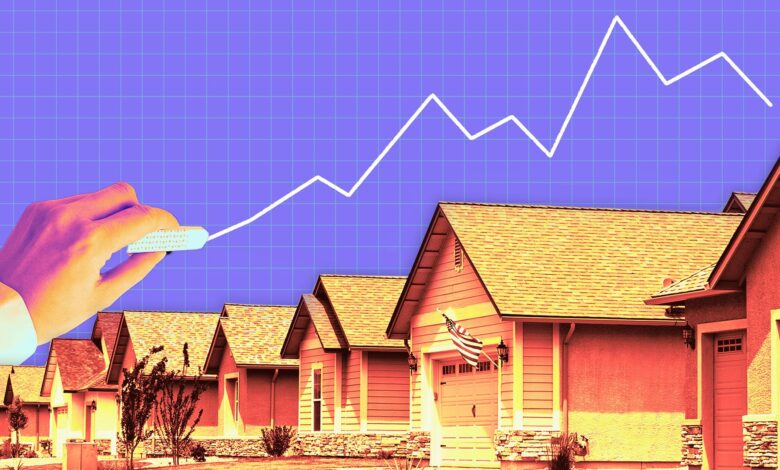

Other factors currently affecting the housing market

The current unaffordable housing market is the result of high mortgage rates, a long-term housing shortage, expensive house prices and a loss of purchasing power due to inflation.

A balanced housing market typically has five to six months of supply. Most markets today average about half that amount. While we saw an increase in new construction in 2022, Zillowwe still have a shortage of approximately 4.5 million homes.

In early 2022, mortgage rates were near historic lows of around 3%. As inflation rose and the Fed began raising rates to curb it, mortgage rates roughly doubled within a year. In 2024, mortgage rates are still high, effectively pricing millions of potential buyers out of the housing market. That’s caused home sales to slow downeven during the busy home buying months, such as spring and early summer.

Because most homeowners stuck in mortgage rates below 6%, with some as low as 2% and 3%, they are reluctant to sell their current homes because it would mean having to buy a new home with a significantly higher mortgage rate. Until mortgage rates drop below 6%, homeowners have little incentive to list their homes for sale, creating a shortage of resale inventory.

Although demand for homes has been subdued in recent years, home prices remain high due to a lack of inventory. The median U.S. home price was $419,300 in May, up 5.8% year-over-year, according to the National Association of Realtors.

High home prices make it difficult for potential buyers to afford a down payment and the cost of a large mortgage. According to a recent research According to CNET’s sister site Bankrate, potential buyers need an annual income of more than $100,000 to be able to afford a house with an average price.

Inflation increases the cost of basic goods and services, reducing our purchasing power. It also affects mortgage rates: when inflation is high, lenders typically set interest rates on consumer loans to compensate for the loss of purchasing power and ensure profits.

Even though the inflation rate is Despite the slowdown in the past year from the peak of 9.1% a few years ago, price growth is still substantial. The latest inflation data shows annual inflation at 3%, still above the Fed’s 2% target.

Will mortgage rates ever be 3% again?

A few years ago, homebuyers could get mortgages with rates between 2% and 3%. Mortgage rates will fall in the coming year, but they won’t reach those levels. Housing experts say it would take a significant economic downturn to push mortgage rates below 3%.

Read more: You’ll Never Get a 2% Mortgage Again: How to Adapt to a Different Housing Market

There is no single “average” mortgage rate. They vary widely depending on how each source, whether it’s a lender or a government-backed agency like Fannie Mae, gathers its data. It’s likely that you’ll see a difference of several percentage points between two sources.

Expert advice for home buyers

It’s never a good idea to rush into a major purchase, like buying a home, without knowing what you can afford, especially with current interest rates. In addition to having a clear budget for buying a home, experts recommend the following:

Build your credit score. Your credit score is one of the most important factors lenders consider when determining whether you qualify for a mortgage and at what interest rate. Working toward a credit score of 740 or higher will help you qualify for a lower interest rate.

Save for a larger down payment. A larger down payment will allow you to take out a smaller mortgage and get a lower interest rate from your lender. If you can afford it, making a down payment of at least 20% will also eliminate the need for private mortgage insurance.

Compare mortgage providers. Comparing loan offers from multiple mortgage lenders can help you negotiate a better rate. Experts recommend getting at least two to three loan estimates from different lenders before making a decision.

Consider the comparison of renting versus buying. Choosing to rent or buy a home isn’t just a matter of comparing monthly rent to a mortgage payment. Renting offers flexibility and a lower upfront cost, but buying allows you to build equity and have more control over your housing costs. The best choice depends on your finances, lifestyle, and how long you plan to stay in one place.

Take mortgage points into account. One way to get a lower mortgage rate is to buy it off with mortgage points. One mortgage point is equal to a 0.25% decrease in your mortgage rate. Generally, each point costs 1% of the total loan amount.