NAB makes huge interest rate announcements – and why millions of Aussies could finally see some relief

- NAB has reduced fixed rate mortgages

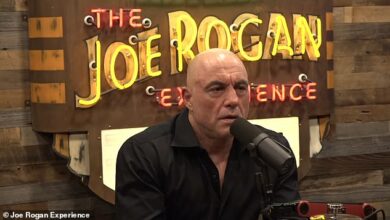

A Big Four bank has cut fixed mortgage rates in a sign that the Reserve Bank could start cutting rates early next year.

National Australia Bank has cut its two-year fixed rate by 55 basis points to 6.04 percent.

The one-year fixed interest rate has been reduced by 40 basis points to 6.29 percent, while the three-year fixed interest rate has been reduced by 10 basis points to 5.89 percent.

Canstar noted that 37 lenders had cut fixed rates in the past month, including Macquarie Bank, which offers a market-leading fixed rate of 5.39 per cent for two to five years.

Australian banks are now offering fixed mortgage rates that are more competitive than variable rates, with financial markets expecting four cuts in the RBA rate by 2025, which would see average mortgage repayments return $5,000 a year.

The minutes of the Reserve Bank’s September meeting were also released on Tuesday, suggesting rate cuts in 2025 are likely.

“On the other hand, members noted that there were scenarios in which future financial conditions should be less restrictive than they currently are,” the report said.

RBA Governor Michele Bullock confirmed last month that a rate hike had not been considered at the Reserve Bank’s September meeting, making rate cuts in early 2025 more likely.

Australia’s economic growth rate of 1 per cent is already the weakest since 1991, the year of a recession, when the impact of the pandemic was ruled out.

A major bank has cut fixed mortgage rates in a sign that the Reserve Bank could cut rates early next year

Underlying inflation of 3.4 percent is still well above the RBA’s target of 2 to 3 percent, but the Reserve Bank’s minutes hinted that price pressures could ease faster than expected.

“One such scenario was that the economy would prove to be significantly weaker than expected and this would put more downward pressure on underlying inflation than expected,” the minutes said.

‘Another scenario was that inflation would prove less persistent than expected, even without weaker-than-expected activity.

“For example, this could happen if rental inflation falls faster, falling prices for gasoline or other commodities significantly reduce companies’ cost bases, or if the decline in discretionary spending feeds through to service sector inflation significantly faster.”

The Reserve Bank’s 13 rate hikes in 2022 and 2023 were the most aggressive since the late 1980s.

But in the 30-day interbank futures market, the spot rate is falling for the first time since March 2023 from the existing 12-year high of 4.35 percent to 3.35 percent.

Should the RBA cut rates four times, as predicted, a borrower with an average mortgage of €636,208 would see their monthly repayments fall by €409 or €4,908 per year.

This would happen if monthly payments dropped from $4,018 to $3,609.