Only about 720,000 Qualcomm Snapdragon

- Report claims that Snapdragon X laptops capture only 0.008% of the global PC market

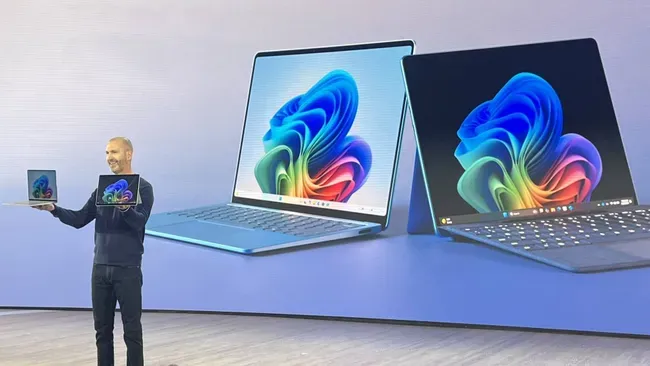

- Microsoft Surface leads Snapdragon X adoption in the niche segment

- Qualcomm faces stiff competition from AMD, Intel and Apple

The PC market remains a challenge for Snapdragon

This figure represents less than 0.008% of the total number of PCs shipped worldwide during the same period, equivalent to less than one in 125 devices.

Despite a remarkable 180% sequential growth in Q3 2024 compared to Q2, the Snapdragon

AI-enabled PCs are gaining momentum

Microsoft and other popular brands have already ported a number of devices to the Snapdragon

Canalys told TechRadar Pro“As this was the first full quarter of shipments for the Snapdragon niche market, with less than 1.5% share. The largest shipment supplier was Microsoft, which transitioned most of their Surface line to the platform. Behind them was Dell, which has embraced the new platform quite strongly in terms of SKU numbers, followed by HP, Lenovo, Acer and Asus (all four with similar volumes).”

While Snapdragon In the third quarter of 2024, shipments of these devices reached 13.3 million units, accounting for 20% of all PC shipments. This category includes desktops and notebooks equipped with chipsets dedicated to AI workloads, such as AMD’s XDNA, Intel’s AI Boost, and Qualcomm’s Hexagon.

Windows devices led the AI-enabled PC market for the first time, capturing 53% of the segment. The surge in demand was supported by the Windows 11 refresh cycle and processor improvements. Sequential growth for AI-enabled PCs was 49%, underscoring the market’s increasing demand for AI-powered computing capabilities.

Nevertheless, AI-enabled PCs face significant hurdles. Canalys data shows that consumers and channel partners remain cautious about adopting these premium offerings. For example, Microsoft’s Copilot+ PCs, which require a minimum of 40 NPU TOPS and other high-end specs, have yet to fully convince buyers of their value.

A survey of channel partners in November 2024 found that 31% do not plan to sell Copilot+ PCs in 2025, while 34% expect these devices to make up less than 10% of their sales. As the end of support deadline for Windows 10 approaches, PC vendors are under pressure to incentivize upgrades among users still dependent on outdated devices.

To differentiate themselves in the competitive AI PC market, vendors are exploring unique strategies. HP has emphasized working with independent software vendors (ISVs) to improve AI experiences on devices. Lenovo has invested in proprietary AI tools embedded in its PCs, such as Creator Zone and Lenovo AI Now.

Dell and Lenovo are using AI on devices to complement their broader AI service ecosystems. Meanwhile, Apple has taken a different approach, focusing on its vertically integrated ecosystem.