Richard Beattie, who helped with the pioneering of private equity acquisitions, dies at 86

- Advertisement -

Richard Beattie, a merged lawyer who helped pioneering private equity takeovers that was immortal in the much-beaten book “Barbarians at the Gate” and that served in the government of Washington and New York, died in his house in Manhattan on Friday. He was 86.

His daughter Lisa Beattie Frelinghuysen said the cause was cancer.

For nearly six decades in the Witte-Shoe New York company Simpson Tacher & Bartlett, the soft Mr. Beattie-Dick, as he was generally known-one of the most wanted business advisers of Wall Street.

He helped compiling AOL’s $ 165 billion takeover of Time Warner in 2001 and JPMorgan Chase’s $ 58 billion takeover from Bank One in 2004, and advised the Board of the Board of American International Group on the Federal Reasonable Redding Preparation of 2008.

He then served from 1991 to 2004 as chairman of Simpson Thacher and as a senior chairman until his death.

But his earliest and most sustainable claim on fame was in the late 1960s, when he carefully recognized that private equity companies – company takeover artists who used debts to buy companies – would become an important force on Wall Street.

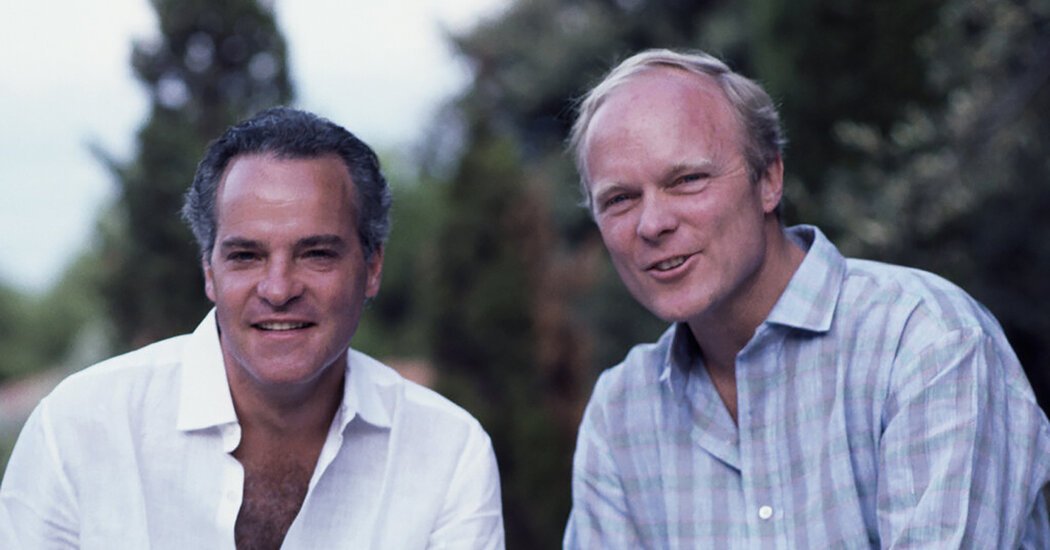

As a young employee, Mr. Beattie introduced to Henry R. Kravis, who would become one of the top names in buyouts in leverage. Mr. Beattie became the go-to council of Mr. Kravis on ever larger acquisitions, with the highlight of $ 25 billion from RJR Nabisco, completed in 1989, which was described by journalists Bryan Burrough and John Helyar in the book ‘Barbarian’s at the gate’, published that year. For ten years, the transaction kept the record as the largest buy -out for leverage.

Mr. Beattie was heavily in the book, negotiated with finer legal points for KKR until late at night – at one point he fell asleep, extended on the floor of the office of another law firm – and looking for a rival bid for Nabisco.

“Dick was always on our side,” said Mr. Kravis, who once tried to lure Mr Beattie to KKR, in an interview.

He was also deeply involved in government and philanthropic work. He took a break from company law in the late 1970s to work in the administration of President Jimmy Carter and became a general adviser for what was then called the Ministry of Health, Education and Welfare (now the Ministry of Health and Human Services).

After he joined Simpson Thacher, Mr. Beattie served in the city of New York Board of Education And set up a non -profit to help the public schools of the city.

“I was lucky to move within the public sector and the private sector,” he told the magazine The American lawyer In 2011. “Once you have become successful, it is important to give back.”

Richard Irwin Beattie Jr. was born on March 24, 1939 in New York City to Richard Sr., a photographer, and Ruth Beattie. He grew up in Rye, NY, where he played Quarterback in high school.

According to his daughter, Mrs. Frelinghuysen, he registered with Dartmouth and became the first in his family to go to university. After graduating in 1961, he joined the Marines for four years and became the pilot of a Douglas A-4 Skyhawk Attack plane. He was known as ‘Night Fighter’, said Mrs. Frelinghuysen, because of his willingness to do volunteer work for nocturnal missions.

In the middle of his military service, in 1963, he married Diana Lewis. Two years later he registered at the Law School of the University of Pennsylvania. While studying for his diploma, his daughters Lisa and Nina were born.

After he joined Simpson Thacher after his graduation in 1968, Mr. Beattie quickly became involved in the emerging activities of business takeovers. The following year he met Mr. Kravis, then a star banker at Bear Stearns.

When Mr. Kravis, together with his cousin George Roberts and Jerome Kohlberg, broke away from Bear Stearns to form KKR in 1976, Mr Beattie continued to advise him on deals. In the process, Mr Beattie by Simpson Thacher helped make a law firm of choice for private equity financiers, with other customers such as Blackstone, Stephen A. Schwarzman’s company being secured.

Clients and colleagues described Mr Beattie as a stable presence at the negotiating table, someone who has never increased his voice in anger. He later served on various boards, including that of Harley-Davidson and the Investment Bank Evercore, who is one of the founders, Roger Altman, an old friend of Mr. Beattie’s, in his early days from Simpson Thacher’s Manhattan office.

“He ordered respect, with a calm intellect and judgment,” said Ralph L. Schlosstein, a friend and fellow carter administration who later helped in finding the money management agency BlackRock and who served as co-chairman and co-chief executive of Evercore.

Mr. Kravis, the most famous customer of Mr. Beattie, also became a friend. The two shared a love for fishing and horse riding. When Mr.’s son Kravis Harrison died in a car accident in the Family Ranch in Colorado in 1991, the Lord Beattie flew with him to bring the body home.

“He was there with me all the way,” Mr. Kravis. “When he was a friend, he was a friend.”

In addition to corporate law, Mr Beattie had a great interest in government and education. At the Department of Health, Education and Welfare, where he worked from 1977 to 1979, he focused on civil rights cases and helped in creating title IX-protection against sex-based discrimination in educational institutions that receive federal funds.

In 1980 he was called to spin the Ministry of Education as a separate cabinet agency; He worked as director of the transition below Shirley M. Hufstedlerwho became the first secretary of education. Decades later, he served in the administration of Bill Clinton as a special envoy for Cyprus.

Education was also a focus of the philanthropic efforts of Mr Beattie. In the 1980s he was asked by Mayor Edward I. Koch van New York to become a member of the Board of Education of the city. In 1989, Mr. Beattie founded new visions for public schools, a non -profit organization that defended smaller public schools in New York; The board was filled with Wall Street leaders.

“Dick was passionate about that public education was the source of upward mobility in our society,” said Mr Schlosstein, who is a member of the New Visions board.

Mr. Beattie also served on the board of Memorial Sloan Kettering Cancer Center.

In addition to Mrs. Frelinghuysen, he is survived by his wife; his daughter Nina Beattie; his younger sister, Evelyn Lewis; And six grandchildren.

David Tatel, a retired federal court of the Court of Appeal and another veteran of Carter’s administration, said there was only one way to describe the Heer Beattie.

“The right word is huge,” he said. “There were giants in the 60s and 70s. There are few giants left today. Dick was one of them.”

- Advertisement -