Trade war breakthrough as the US and China agree to reduce the rates by 115% for 90 days

- Advertisement -

The US and China have agreed a breakthrough temporary cutout of the rates They impose each other’s exports.

In Geneva, the American finance minister Scott Bessent said that both countries would lower their mutual rates by 115 percent for 90 days.

Bessent said reporters that ‘both parties showed a lot of respect’ during their conversations, and that ‘we are both interested in balanced trade’.

Since the announcement, the world markets have been with Hong Kong More than three percent more, while Shanghai also enjoyed a healthy purchase interest. Tokyo, SydneySeoul, Taipei and Wellington were all in the Green and LondonParis and Frankfurt all rose by more than one percent.

The announcement came after both China and the US had held commercial conversations this weekend in Switzerland, which had previously described Bessent as ‘productive and constructive’.

The crucial meeting was the first between the two countries since the American president Donald Trump hit steep rates against China on his goods that America entered in January.

Trump had imposed a stunning rate of 145 percent on Chinese import, while Beijing Waald with a levy of 125 percent on some American products.

The mega rates caused unrest in the financial markets and led to the fear of a global recession, but the American rates for Chinese import will now be reduced to 30 percent for 90 days, while Chinese rates for the entry of the US will be reduced to 10 percent for the same period.

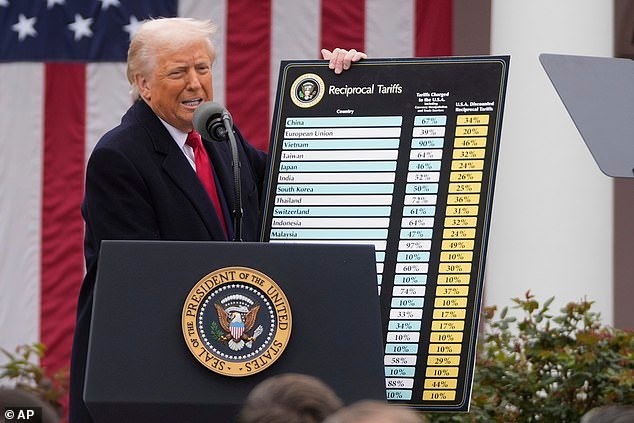

US President Donald Trump speaks during an event to announce new rates in the Rozentuin in the White House on 2 April 2025 in Washington

In Geneva, the American Finance Minister Scott Bessent would reduce their mutual rates by 115 percent for 90 days

American secretary of the Treasury Scott Bessent and the American trade representative Jamieson Greer treat the media after trade discussions with China in Geneva, Switzerland, 11 May 2025

The two parties also agreed to ‘establish a mechanism to continue discussions about economic and trade relationships’, led by the Chinese Vice Prime Minister He Lifeng and the American Minister of Finance Scott Bessent and the American trade representative Jamieson Greer, according to the statement.

‘These discussions can be carried out alternately in China and the United States, or a third country after the approval of the parties.

“As required, the two parties can consult work level consultation about relevant economic and trade issues,” it added.

The American side has also suggested that they have agreed a ‘very good mechanism’ to prevent unhappy escalations with China in the future.

Prior to this morning the announcement, both parties had played a potential deal, although no details had been announced.

Chinese media described the meeting between China and the US as the creation of a mechanism for further conversations by having agreed to setting up “an economic and trade consultation mechanism,” while President Trump said that the couple had “a total reset negotiated.”

But the news was received positively on Monday by Asian stock markets when large indexes shot up.

Before the 90-day break announcement in China, the Shanghai Composite Stock Index rose by 0.7 percent, the Shenzhen component achieved 1.7 percent and the Hong Index of Hong Kong rose by 1.2 percent.

Benchmark also rose in countries in Asia.

Korea’s Kospi grew 1.1 percent, the Japanese Nikkei rose by 0.8 percent, while India’s Nifty 50 index of the most valuable companies won more than three percent.

Trump imposed the biggest set of rates to China when he announced a 145 percent tax on most goods from Beijing. Displayed: Chinese President Xi Jinping arrives in Moscow, Russia on May 9, 2025

The FTSE 100 jump to the start of the trade with a hanging, while Seng in Hong Kong jumped by more than three percent. Wall Street shares were also on their way to open about three percent higher.

While oil prices rose more than three percent, the dollar jumped against large currencies, making the euro on its way this year for the worst day.

William Xin, chairman of Hedgefonds Spring Mountain Pu Jiang Investment Management in Shanghai, said: ‘The result is much more than market expectations. Earlier, the only hope was that the two parties could sit to talk, and the market would have been very vulnerable.

‘Now there is more certainty. Both China shares and the Yuan will be in a revival for a while. ‘

Mumbai jumped more than three percent all over the world after India and Pakistan stopped at the weekend -the fires corresponded to four days of rocket, drone and artillery -attacks between the two countries that killed at least 60 people and fled thousands.

The Pakistan stock market shot up more than nine percent.

Gold, which gathered last month over an almost to safe ports, extended losses.

“The first reaction to the weekend that US-China Talks (is) predictably encouraging,” said Chris Weston at Pepperstone.

Karsten Junius at Bank J. Safra Sarasin, however, was careful.

“We expect that the financial markets will remain volatile in the coming months, because they are almost completely priced of negative economic surprises and can be disrupted again by more serious obstacles in trade negotiations,” he said in a comment.

“In all likelihood it can still get worse before they get better.”

Investors are also waiting for the release of data on American inflation and retail sales this week, which will offer a new snapshot of the largest economy in the world, because the rates were revealed for the first time.

This is one Breaking News story. More to follow.

- Advertisement -