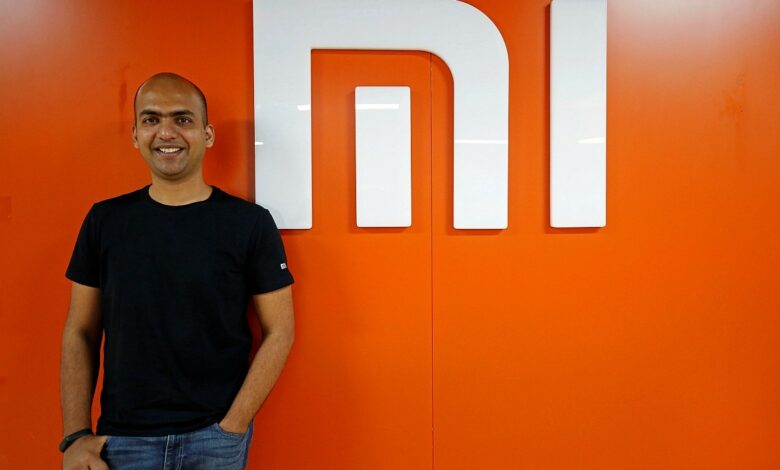

Xiaomi Global Vice President Manu Kumar Jain skips ED questioning

Manu Kumar Jain, the global vice-chairman of Chinese mobile company Xiaomi, failed to appear for questioning before the Enforcement Directorate (ED) on Wednesday and sought more time to participate in the investigation.

The Enforcement Directorate has summoned Jain, former head of Xiaomi’s India unit, in a case related to violation of provisions of the Foreign Exchange Management Act (FEMA). The Enforcement Directorate is investigating the case referred by the Income Tax Department.

Sources told ANI that Jain has expressed his unwillingness to appear before ED today and sought more time to join the probe. Now, ED will issue fresh summons to Jain to join the probe.

According to sources, the Ministry of Finance is investigating the matter and it is questionable whether the company has violated FEMA, as the Income Tax Authorities suspect.

In December 2021, the Income Tax Department conducted searches for Chinese mobile companies Xiaomi, Oppo, OnePlus and some other Chinese Fintech companies. The searches were conducted at various locations pertaining to these companies spread across different parts of the country including Karnataka, Tamil Nadu, Assam, West Bengal, Andhra Pradesh, Madhya Pradesh, Gujarat, Maharashtra, Bihar, Rajasthan and Delhi NCR.

Sources in the ED told ANI that Xiaomi has been remitting royalties to and on behalf of its group companies abroad, the total value of which is over Rs 1,000 crore.

The claim of such expenditure does not seem to be appropriate in light of the collected facts and evidence. During the investigation, ED found that Xiaomi had not complied with the legal mandate for disclosure of transactions with affiliates. Such lapse makes them liable for action.

Foreign funds have been entered in the books of the Indian company but it appears that the source from which such funds have been received is of dubious nature, reportedly without creditworthiness of the lender. The size of such loans amounts to crores of rupees, on which interest charges have also been claimed.

Sources told ANI that evidence of inflation of expenses and payments made on behalf of the affiliated companies has also been found, leading to a reduction in the taxable profits of the Indian mobile phone company.